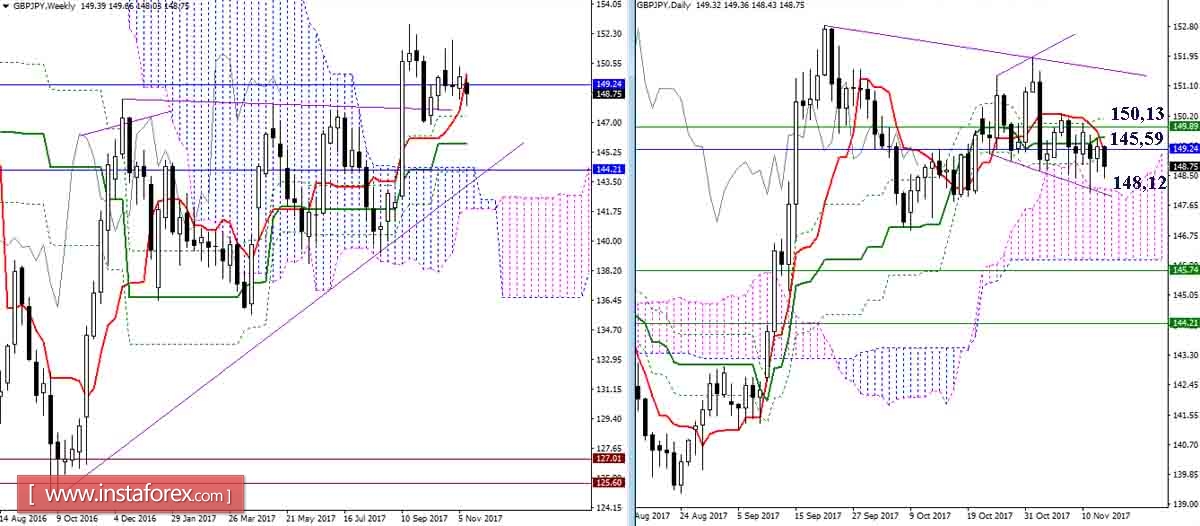

GBP / JPY

Over the past 24 hours, the situation did not change significantly. The antagonism under the day's cross continues. Players on the rise could not cope with a number of combined resistance forces (daytime Tenkan 149.17 + daytime Kijun 149.59 + daytime Fibo Kijun 150.13 + week Tenkan 149.88 + month Fibo Kijun 149.24). At the same time, the strength of the bears cannot even be talked about. The day cloud (Senkou Span A 148.12) reliably performs the role of support and has long been resisting the intensification of bearish sentiments.

The cloud of H4 is quite wide. It now combines almost all the resistance from the older timeframes in the range of(149,17-24-59-88 - 150,13). Henceforth, overcoming the cloud can significantly change the existing balance of power and open up new prospects for players.

Bear interests continue to include the level of 148.12 (daytime Senkou Span A) and 147.42 (weekly Fibo Kijun).

EUR / JPY pair

Players on the rise who are coming out of the day's cloud, used the current level as a support. It further props up the support in the daily short-term trend at the level of 132.58. As a result, the pair overcame the middle of the expanding formation and conquered new heights. A continuous recovery is expected if it is now possible to consolidate the result and overcoming these levels will be allowed to perform the role of support. In this case, the main task for players to rise is to update the high at the level of 134.51 and restore the global uptrend.

Getting rid of the resistance of the H4 cloud and after forming a new upward goal, the players rushed to new heights. At the moment, the target for the bulls is the target for the breakdown of the H4 cloud at 134.05-35 and the maximum boundary at the level of 134.51. For today, the role of the most powerful supports remain at the levels of 133.31 - 132.95 - 132.98.

Indicator parameters:

all time intervals 9 - 26 - 52

The color of indicator lines:

Tenkan (short-term trend) - red;

Kijun (medium-term trend) - green;

Fibo Kijun is a green dotted line;

Chikou is gray;

clouds: Senkou Span B (SSB, long-term trend) - blue;

Senkou Span A (SSA) - pink.

The color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray;

horizontal levels (not Ichimoku) - brown;

trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română