On Tuesday, the single European currency received a boost in the aftermath of the release of strong data on Germany's GDP and the eurozone. Recent data showed the presence of sustained economic growth.

Positive news has provoked a growing interest in euro-denominated assets and also likely raised hopes in the market that the ECB will have to return to the topic of the exchange rate policy.

According to the data, the preliminary annual GDP estimate of Germany for the third quarter increased by 2.3% against 1.0% a period earlier. At the same time, the quarterly figures also showed an upward trend in growth from 0.6% to 0.8%. On this wave, the euro began to grow smoothly against all major currencies, including the US dollar. Moreover, its growth significantly increased when the data on the eurozone's GDP came out, which turned out to be in line with forecasts and also confirmed the continuation of a strong positive trend in the region's economy. In annual terms, the euro area's GDP in the third quarter grew by 2.5%, as with the period earlier. For the quarter, it also gained 0.6%, as well as the previous quarter.

At the moment, let's try to figure out if the euro has any further growth prospects.

Yes, certainly, there are, but only if inflationary pressures in the region increase. Afterwards, the ECB will be forced to restrain the process of curtailing incentive programs. However, this is exactly the problem. In October, consumer inflation did not rise, and instead had decreased from 1.5% to 1.4%, which is noticeably below the target of 2.0%. Published data on consumer inflation showed a decline towards 1.6% against 1.8% a month earlier. Thus, it can be assumed that the November data on this indicator may also turn out to be gloomy, which means that it is possible to believe that the growth of the euro is purely speculative and temporary. Therefore, we believe that it should be sold on this limited growth on the wave of technical signals about overbuying.

A decline in the euro could intensify if the data released today on consumer inflation in the United States shows a rise above forecasts. Such a hope exists, as the data on production inflation that was presented on Tuesday showed an increase that was above forecasts. If this happens, we can expect not only the return of the euro to yesterday's opening level against the US dollar, but also its further decline towards recent lows.

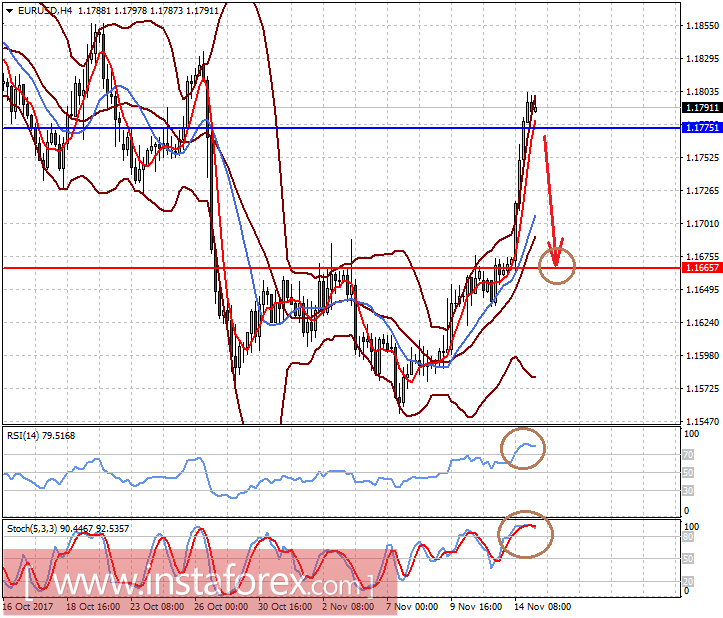

Forecast of the day:

The EURUSD pair has reached a local peak, but could shift downwards if the data on consumer inflation in the US turns out to be higher than expected. Against this background, the pair could fall to 1.1665 with the prospect of a further decline towards 1.1550.

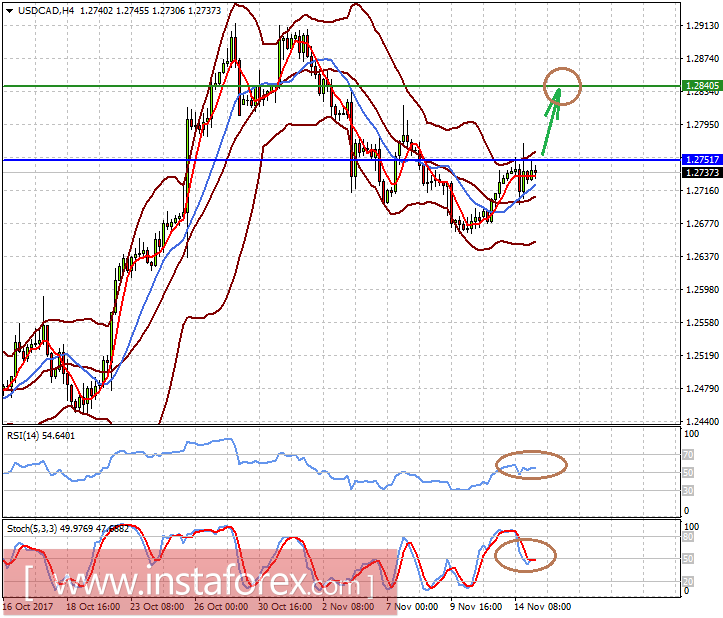

The USDCAD pair is consolidating below the level of 1.2750, on the wave of a correction in crude oil prices and in anticipation of data from the United States. Positive news will push the pair upwards and overcoming the 1.2750 mark might cause it to grow to 1.2840.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română