EUR / USD, GBP / USD

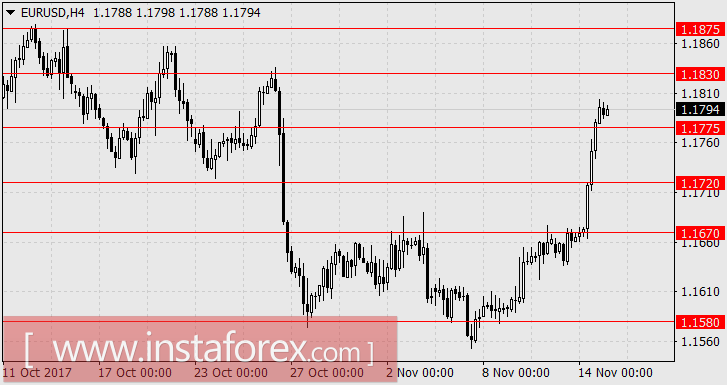

According to Tuesday's results, the euro showed an impressive increase of 130 points. Formally, it is believed that this contributed to the data on Germany's GDP and ZEW indexes. However, a significant movement such as this with no support from other markets, indicates the speculative nature of this growth. Speculators from the "bulls" could not hide behind a conference of bankers in Frankfurt, as none of the four leaders of the largest central banks said anything new. Other currencies practically did not react to these events.

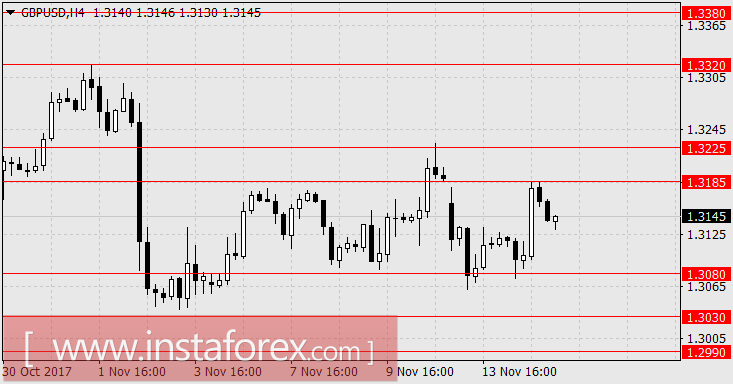

So, Germany's GDP for the 3rd quarter in the second assessment was increased from 0.6% to 0.8% while GDP on an annual basis was revised more significantly from 0.8% to 2.3%. The index of sentiment in business circles of Germany ZEW for November increased from 17.6 to 18.7. In the euro area, this index increased from 26.7 to 30.9. Industrial production of the eurozone in September decreased by 0.6%. In the UK as a whole, the inflation indicators for October increased. The index of retail prices increased from 3.9% y / y to 4.0% y / y. House prices increased from 4.8% y / y to 5.4% y / y. The basic CPI remained at the level of 2.7% y / y. The general CPI was also held at 3.0% y / y with the expected growth of the index for both indicators at 0.1%. In the Asian session today, the pound has already played half of yesterday's growth. We can assume that the growth of the euro was a hunt for stop-loss sellers and if this is true, then the subsequent decline of the euro for fundamental reasons will certainly take place. The volume of trading was less than the 9th, when the euro grew by 47 points. This means that the market turned out to be thin yesterday. According to rumors, the Central Bank of Serbia bought the euro yesterday. Well, now sellers need to connect.

Today, the report on the trade balance of the eurozone for September will be published. The forecast is 21.2 billion euros against 21.6 billion in August. Data on employment in the UK can not be optimistic. The number of applications for unemployment benefits for October is expected at 2.3 thousand versus 1.7 thousand in September. The average wage level without premiums for the last three months is expected to grow by 2.2%. This excludes premiums by 2.1% compared to 2.2% previously. The unemployment rate is expected to be unchanged at 4.3%.

Certainly, no optimism is expected for the US either. Retail sales in October are projected with zero change. Basic retail sales may show an increase of 0.2%. The total CPI for October is projected to increase by 0.1% and the basic CPI growth by 0.2%. The index of business activity in the manufacturing sector of New York for the current month may fall from 30.2 to 25.5. The inventory of companies in the September estimate are projected with zero change. US President Trump returned from Asia and is preparing for the Senate vote on tax reform on Thursday.

It is difficult to guess how long the inertial growth of the euro will continue. Perhaps the target of speculators may be the range of 1.1830 / 75 or perhaps the price will not exceed 1.1830. In the medium term, we expect the price to return to 1.1670. For the pound sterling, we do not expect an output in the range of 1.3185-1.3225. Instead, we will soon expect a price in the range of 1.2990-1.3030.

USD / JPY

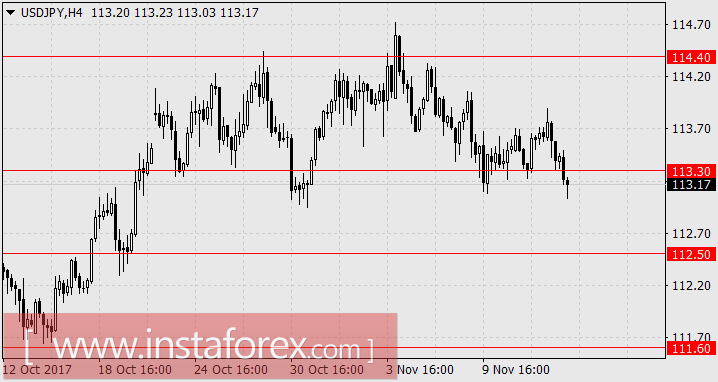

No matter how good the economic performance of Japan is, the yen can not grow if there is no growth in the stock markets. Yesterday, the S&P 500 fell by 0.23%, the Russell 2000 declined by 0.29% and today, the Japanese Nikkei 225 is the leader of the fall in the APR with a drop of 1.35%. At the same time, Japan's GDP for the third quarter increased by an expected 0.3%. On an annualized basis, the gain was 1.4% y / y against expectations of 1.3% y / y. Worse than the forecast were capital expenditures for the third quarter. There is an increase of 0.2% against 0.3%. Consumer spending decreased by 0.5% over the same period, against the forecast of -0.4%. Thus, as long as investors do not see optimistic moves in the stock market because of consistency in the US Congress on Trump Tax Reform, the yen is unlikely to grow. Also, the yield on the main types of government bonds in Japan is declining for the fourth consecutive day.

We are waiting for the yen to decline to 112.50.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română