The euro rose in the first half of the day against the US dollar against the backdrop of good fundamental statistics on the German economy.

According to the report, Germany's economy for the third quarter grew, receiving support from the growth in demand in foreign markets as well as through increased investment of companies. Thus, the gross domestic product in the third quarter of this year increased by 3.3% compared with the same period last year after rising by 2.6% in the second quarter. Economists had expected 2.4% growth in the third quarter.

The sentiment in the German economy improved in November, which also positively affected the euro. According to the report of the ZEW research center, the index of economic expectations in Germany for the month of November this year rose to 18.7 points against 17.6 points in October. Economists had expected the index to reach 20.1 points.

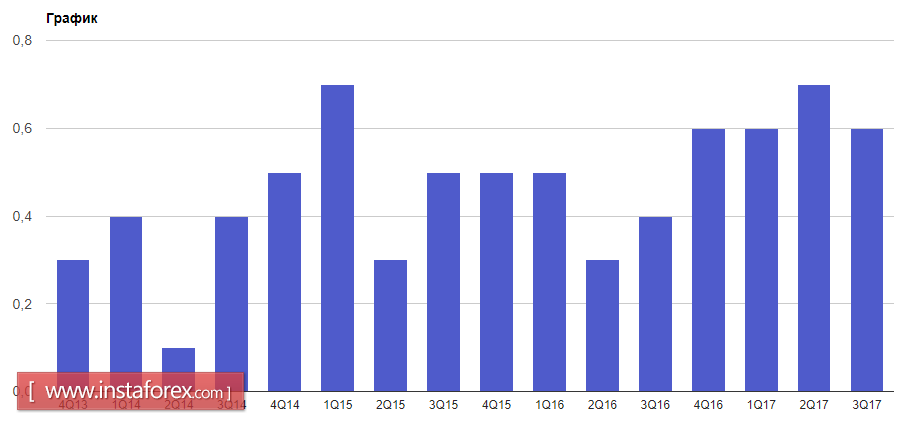

According to the Eurostat, the eurozone's GDP in the third quarter of this year continued to grow. Thus, according to preliminary estimates, in comparison with the second quarter of this year, GDP growth was 0.6%. Compared to the same period in 2016, the economy grew by 2.5%. All these data fully coincided with the forecasts of experts.

The main driver of growth was Germany. In Italy, the growth rate of the economy fully coincided with the forecasts of economists.

From today's speech, the head of the European Central Bank Mario Draghi indicated that he intends to adhere to a soft monetary policy for quite a long time. As Draghi said, the ECB's benchmarking experience regarding the future policy has been successful and there is no point in abandoning the successful instrument in influencing the economy.

Today, there waes also an address by the representative of the Federal Reserve Bank Evans. He said that it is time for the US Central Bank to form a new monetary policy. The Fed needs to withstand a test of trust due to the fact that the target level of inflation has not been achieved. As for the prospect of changing interest rates, Evans did not comment on it.

Today, Fed Chairman Janet Yellen will speak in the afternoon. Perhaps she will be able to give a clearer guidance on the rate increase which is scheduled for the end of this year. If this happens, the demand for the US dollar may increase.

As for the technical picture, the breakthrough of the upper boundary of the side channel and the rapid growth at the stop orders in the area of resistance at 1.1730 occurred. At the moment, the main task is to keep this area. In case of a correction down, bulls will try to close the daily trade above 1.1685. This will retain short-term upward potential for the euro in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română