Comments by ECB banking supervision member, Kerstin af Jochnick

Adding that "the baseline scenario of our projections cannot be taken for granted". This could be a personal opinion but it also reflects the downside risks to the outlook, which I would expect to be brought up by Lagarde in her press conference later today.

Looking at the ECB decision later, recent virus developments have arguably accelerated the pace for more action by the ECB and they may very well bring forward their PEPP expansion decision to today, should there be a need to act preemptively.

Further Development

Analyzing the current trading chart of Gold, I found that there is the strong breakout of the consolidation and support at $1,891 as I expected.

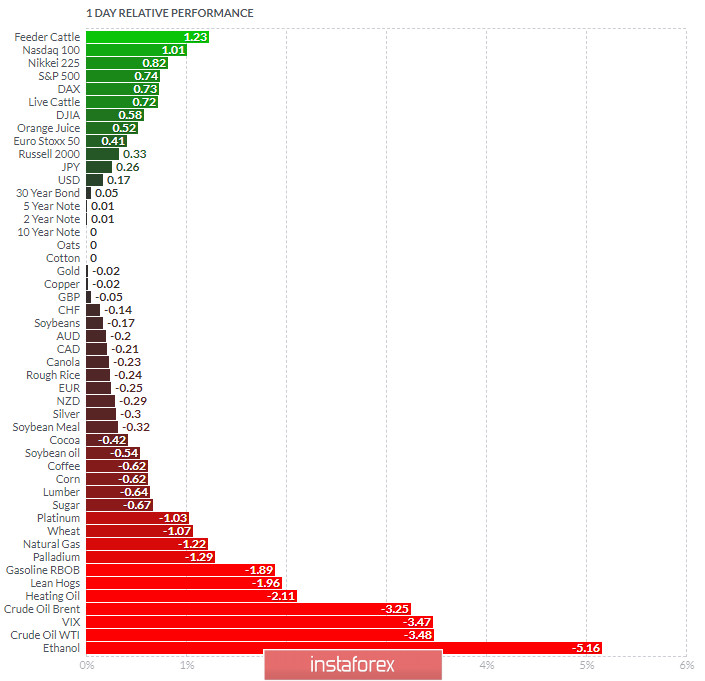

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Feeder Cattle and Nsdaq and on the bottom Ethanol and Crude Oil.

Key Levels:

Resistance: 1,891

Support levels: $1,848

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română