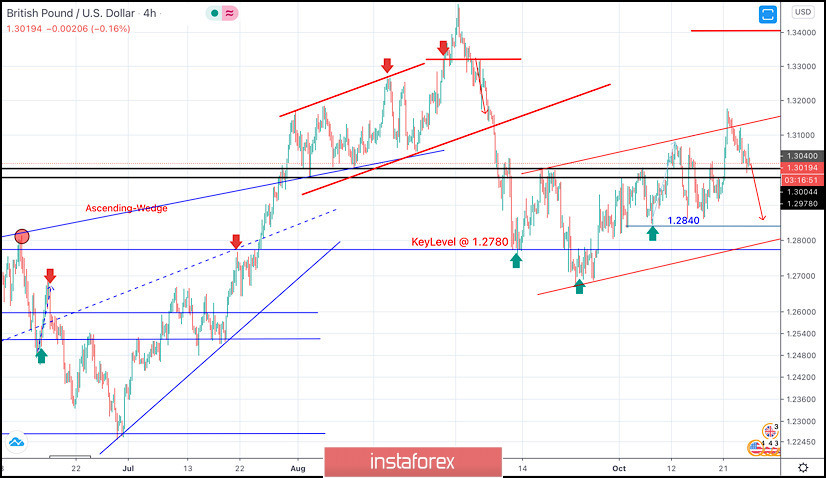

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts.

However, On September 1, the GBPUSD pair looked overbought after such quick bullish movement while approaching the price level of 1.3475.

That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the newly-established key-level of 1.3300.

A quick bearish decline took place towards 1.2780 where considerable bullish rejection brought the pair back towards 1.3000 and 1.3100 during the past few weeks.

The price zone of 1.3130-1.3150 (the depicted trend line) remains an Intraday Key-Zone to determine the next destination of the GBPUSD Pair.

Bullish Persistence above the mentioned price zone of 1.3100-1.3150 will probably allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested bullish pattern.

However, the GBPUSD pair failed to do so, Instead, another bearish movement will probably be expressed towards the price level of 1.2840 where bullish SUPPORT will probably exist.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română