BOE's Vlieghe: Tiering has been effective in getting the benefits of negative rates, while reducing costs

- BOE would have some tolerance for short-term inflation cased by no-deal Brexit

- Main concern about a no-deal Brexit is on business, consumer confidence and the exchange rate

The headline comment continues to make a case for negative rates to be introduced by the BOE in the future.

"My own view is that the risk that negative rates end up being counterproductive to the aims of monetary policy is low."

Further Development

Analyzing the current trading chart of EUR, I found that EUR is trading close to my second target at 1,1825 and that there is still chance for strong upside swing.

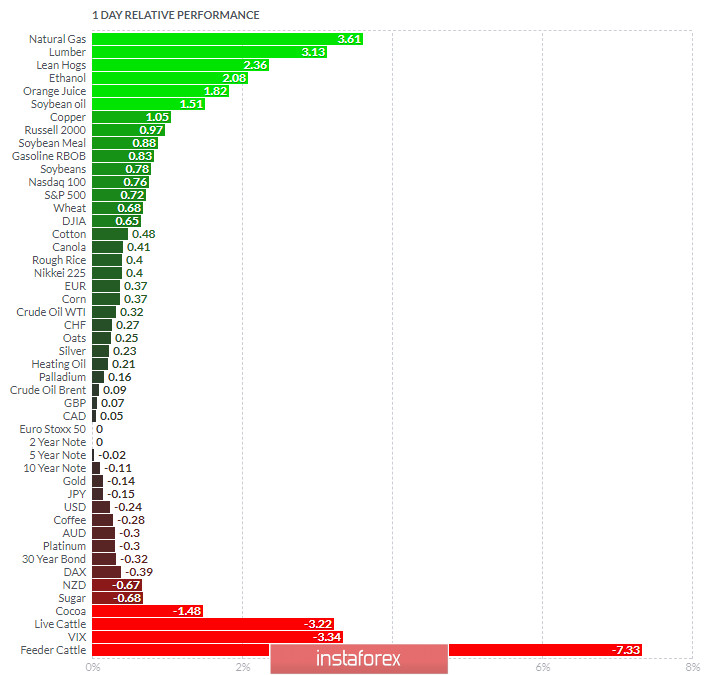

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural gas and Lumber today and on the bottom Feeder Cattle and VIX.

Key Levels:

Resistance: 1,1825 and 1,1870

Support level: 1,1770

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română