The EUR/USD pair dropped perfectly, remain bearish for a further drop today.

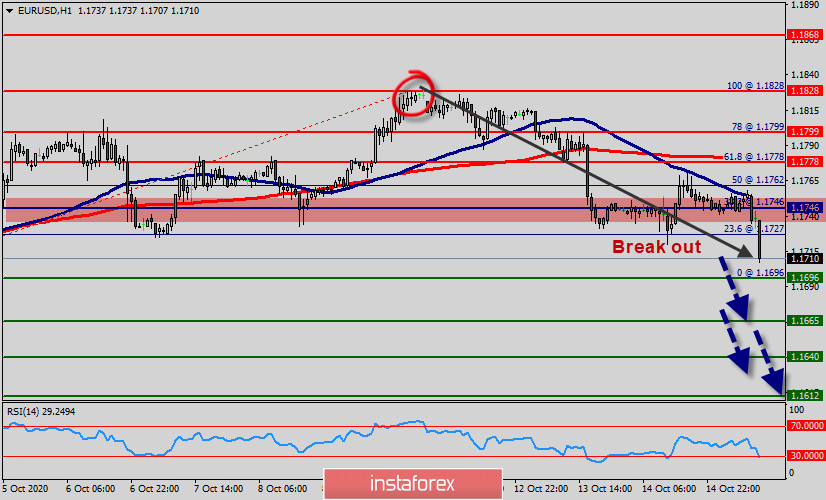

After a breakout at the price of 1.1746 this morning, support now becomes resistance at the level of 1.1746.

The EUR/USD pair broke resistance which turned to strong resistance at the level of 1.1746.

The level of 1.1746 coincides with 38.2% of Fibonacci, which is expected to act as major resistance today.

Since the trend is above the 38.2% Fibonacci level, it means the market is still in a downtrend.

From this point, the EUR/USD pair is continuing in a bullish trend from the new support of 1.1746.

Currently, the price is in a bearish channel. According to the previous events, we expect the EUR/USD pair to move between 1.1746 and 1.1612. On the H1 chart, resistance is seen at the levels of 1.1746 and 1.1778.

A bearish outlook remains the same, as long as the 100 EMA is pointing to the downside. RSI (14) sees major descending resistance line acting as resistance to push price down from the spot of 1.1746 - 1.1762 .

We still expect the bearish trend for the upcoming sessions as long as the price is below 1.1746 level. Also, it should be noticed that, the level of 1.1746 represents the daily pivot point.

The bias remains bearish in nearest term testing 1.1696 – 1.1612. Immediate resistance is seen around 1.1746.

Therefore, strong resistance will be formed at the level of 1.1746 providing a clear signal for sell deals with the targets seen at 1.1696.

If the trend breaks the support at 1.1696, the pair will move upwards continuing the development of the bearish trend to the level 1.1665 in order to test the daily support 2. Next objectives 1.1640 and 1.1612.

Alternative scenario :

The breakdown of 1.1778 will allow the pair to go further up to the levels of 1.1800 and 1.1830.

Otherwise, the breakdown of 1.1778 will allow the pair to go further up to the levels of 1.1800 and 1.1830. Besides, is should be noted that all positions must be closed before the closing bell in New York session to day.

But overall I still prefer a bearish scenario at this phase. Moreover, any downside pullback from the price of 1.3823 now is normal, because on the whole we remain bearish at present.

Forecast :

It will be good deal to sell at 1.1746 with the first target of 1.1696. It will also call for a downtrend in order to continue towards 1.1665 and 1.1640. The weekly strong support is seen at 1.1612. On the contrary, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.1778 (R1).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română