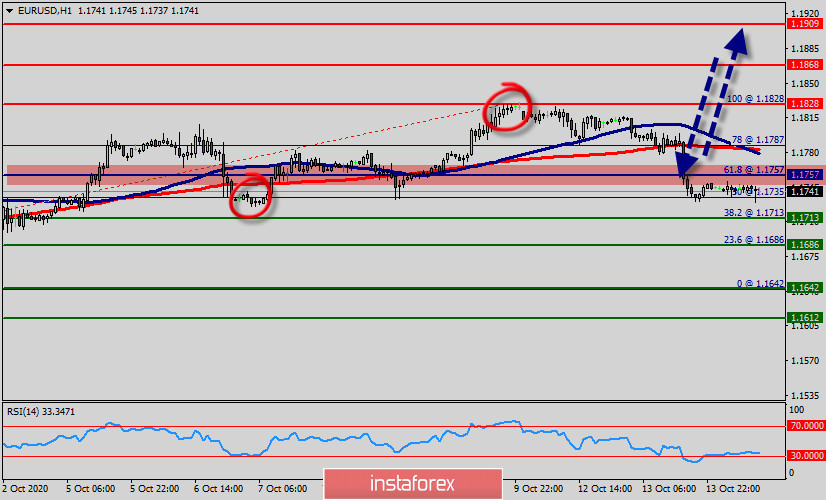

The EUR/USD pair sets on major support right now for that we remain bullish. Price is starting to bounce nicely off our major support area starting from 1.1740. The EUR/USD pair moved higher and closed the day in positive area around the 1.1740-1.1757 levels. The EUR/USD pair will probably continue to rise from the level of 1.1740-1.1757 in the long term. It should be noted that the support is established at the level of 1.1757 which represents the 61.8% Fibonacci retracement level on the H1 chart.

The price (1.1757) is likely to form a double bottom in the same time frame. Accordingly, the EUR/USD pair is showing signs of strength following a breakout of the highest level of 1.1740-1.1757. We expect to see a strong reaction off this level to push price up towards 1.1828 before 1.1757 support. RSI (14) sees a bullish way out of our ascending support-turned-resistance line signalling that we'll likely be seeing some bearish momentum between the levels of 1.1828 - 1.1757. This suggests the pair will possibly go up in coming hours.

A daily closure above .1828 allows the pair to make a quick bullish movement towards the next resistance level around 1.1868. However, traders should watch for any signs of bearish rejection that occur around 1.1828 - 1.1755. The pivot point stands at 1.1755. The pair is trading above its pivot point. It is likely to trade in a higher range as long as it remains above the pivot point. Long positions are recommended with the first target at 1.1868. A break of that target will move the pair further downwards to 1.1909. Today, the price is in a bearish channel now as long as the trend is still set above the spot of 1.1755. Amid the previous events, the pair is still in an uptrend.

The EUR/USD pair is continuing in a bullish trend from the new support of 1.1755. Buy above the level of 1.1757 with the first target at 1.1868 in order to test the daily resistance 1 and further to 1.1909. Also, it might be noted that the level of 1.1909 is a good place to take profit because it will form a new double top. On the other hand, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.1757, a further decline to 1.1642 can occur which would indicate a bearish market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română