He reinforces that there is 'strong' EU unity ahead of the European Council meeting later this week and that they will continue to work for a fair Brexit deal in the coming 'days and weeks'. I think the mention of 'weeks' says a lot about what they are expecting.

Further Development

Analyzing the current trading chart of Gold, I found that there is completion of the downward correction (bull flag pattern), which is good indication for the further rise on the Gold.

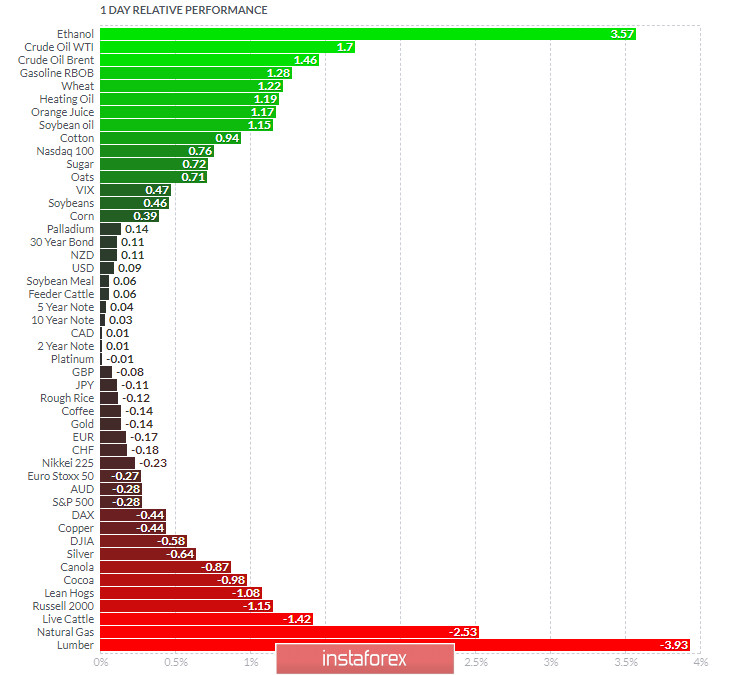

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Crude Oil today and on the bottom Lumber and Natural Gas.

Key Levels:

Resistance levels: $1,931 and $1,954

Support level: $1,910

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română