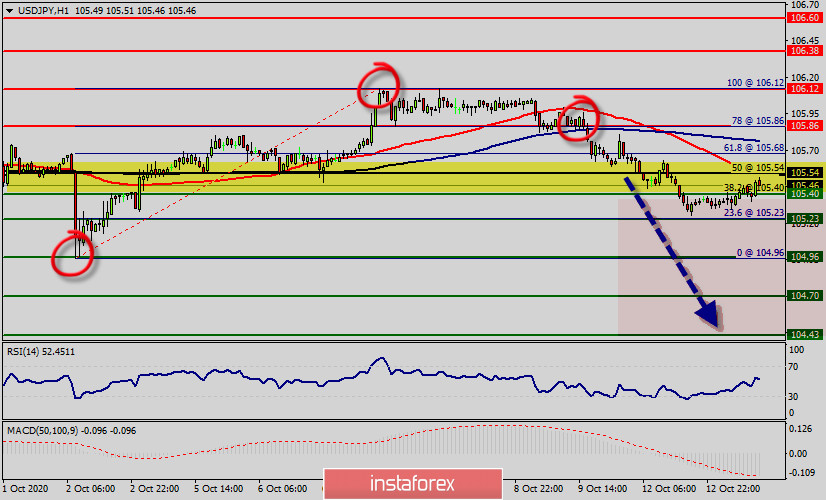

- Yesterday, the USD/JPY pair reached a new minimum at the price of 105.40. So, today the price may reach one more minimum around the spot of 105.23, which coincides with the ratio of 23.6% Fibonacci. Today, the USD/JPY pair is challenging the psychological resistance at 105.54. So, the first resistance is seen at the level of 105.54 in the one-hour time frame. We expect the GBP/USD pair to continues moving in a downtrend below the level of 105.54 towards the first target at 104.96 so as to test the double bottom. Major support is found at the level of 104.70. We guess that the pair will be traded lower in the early session and try to reach minor support at the level of 105.23. The bias is neutral in the nearest term probably with a little bearish bias testing 105.23 area, which needs to be clearly broken to the down side to keep the bearish scenario. RSI (14) has made a recent bearish Letout which is in line with the bearish exit we're seeing in price. On the downside, a clear break at the level of 104.96 could trigger further bearish pressure testing 104.70, which represents the major support today.

Forecast :

As a result, it is gainful to sell below this price of 105.54 with targets at 104.96 and 104.70. However, the bullish trend is still expected for the upcoming days as long as the price is above 105.86.

Daily Technical level :

- Major resistance: 106.12

- Minor resistance: 105.86

- Intraday pivot point: 105.54

- Minor support: 104.96

- Major support: 104.70

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română