"With two heavyweight insider MPC members (Haldane and Ramsden) coming out publicly in opposition, at least at the moment, we see a high barrier to negative policy rates. We now think that outright cuts in the bank rate to below zero in a WTO-style Brexit outcome looks less plausible. Instead, adjusting TFS and providing term funding at negative rates, while leaving the bank rate at 0%, looks like the more plausible option."

As I discussed in the previous review, the Gold managed to complete the downside correction and I expect further upside movement.

Further Development

Analyzing the current trading chart of Gold, I found that buyers are in control today and that we can see further upside continuation.

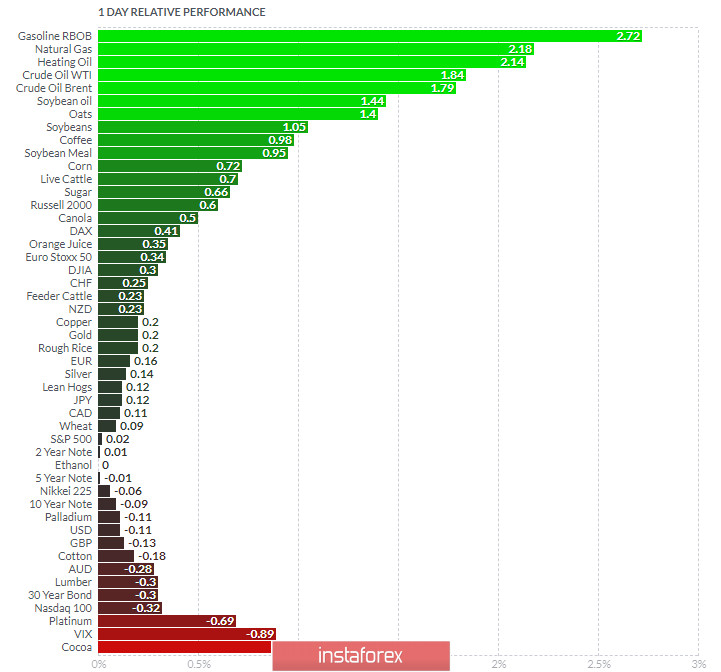

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Gasoline RBOB and Natural Gas and on the bottom Cocoa and VIX.

Gold is positive on the relative strength list...

Key Levels:

Resistance: $1,919 and $1,933

Support levels: $1,906 and $1,855

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română