Overview :

Technically :

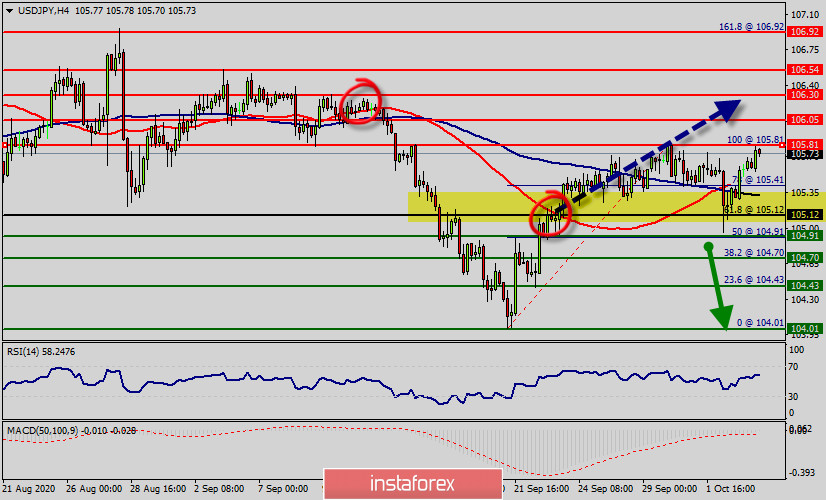

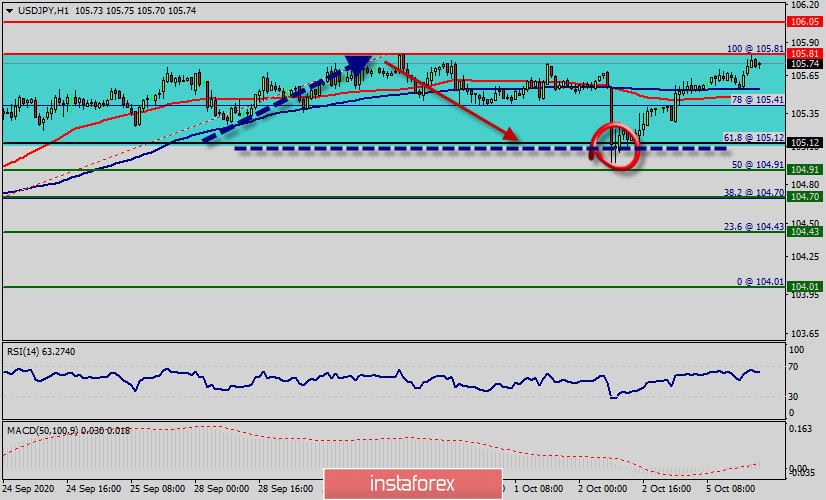

The USD/JPY pair is still trading above strong support level of 105.12.

Amid the previous events, the price is moving between the levels of 105.12 and 105.81 since last week.

The trend of USD/JPY pair movement was controversial as it took place in a narrow sideways channel. The daily resistance and support are seen at the levels of 105.81 and 105.12 respectively.

Therefore, it is recommended to be cautious while placing orders in this area. So, we need to wait until the sideways channel has completed. RSI is calling for neutral in coming hours.

However, if the pair fails to pass through the level of 105.12, the market will indicate a bullish opportunity above the strong resistance level of 105.2. Since there is nothing new in this market, it is not bearish yet.

Consequently, the first support is set at the level of 105.12. Hence, the market is likely to show signs of a bullish trend around the spot of 105.12.

Buy-deals are recommended above 105.12 with the first target seen at 105.81. The movement is likely to resume to the point 106.05 and further to the point 106.30.

On the other hand, if the USD/JPY pair fails to break through the resistance level of 105.81, the market will decline further to 105.12. The pair is expected to drop lower towards at least 104.91 with a view to test the weekly pivot point.

Also, it should be noted that the weekly pivot point will act as minor support today. Major support level is set at the price of 104.01 (double bottom).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română