However, we'll have to see how the trend looks like towards the end of Q3 and the early stages of Q4 to determine if the recovery pace can keep up

As I discussed in the previous review, the EUR managed to complete the downside correction ABC major, which can open the room for the another upside swing.

Further Development

Analyzing the current trading chart of EUR, I found that the buyers are in control today and there is potential for the higher prices.

My advice is to watch for buying opportunities on the intraday pullbacks with the upside targets at 1,1880 and 1,1900.

Additionally, there is the breakout of the 3-day balance to the upside.

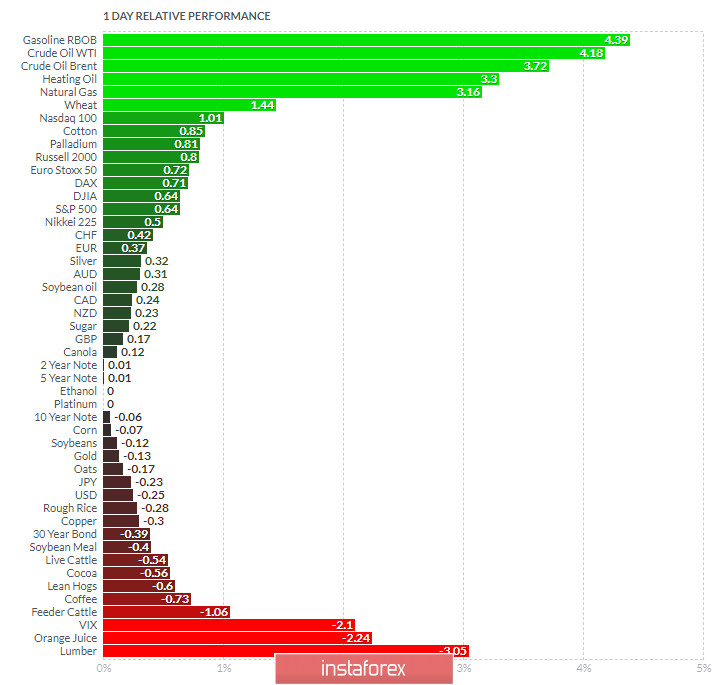

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural Gas and Crude Oril today and on the bottom Lumber and Orange Juice

Key Levels:

Resistance: 1,1768

Support level: 1,1695

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română