The "risk off" trade is on as the market reacts to the news that President Trump has tested positive for Covid-19 virus. VP Pence has tested negative. The JPY is the strongest. The AUD is the weakest. The USD is more strong with gains vs all major currencies with the exception of the GBP and JPY. The GBP is higher on news that PM Johnson is inserting himself into the Brexit negotiations picture and will meet with EU president von der Leyen tomorrow. The US stocks are lower. Of course, we have US jobs at 8:30 AM ET/1230 GMT with expectations for 850K (vs 1.37M last month). The unemployment rate is expected to come in at 8.2% from 8.4%.

As I discussed in the previous review, the EUR is holding the support at 1,1700, which might be the sign that buyers are in control.

Further Development

Analyzing the current trading chart of EUR, I found that there is the successful test of the low at 1,1705, which is positive for the further upside movement.

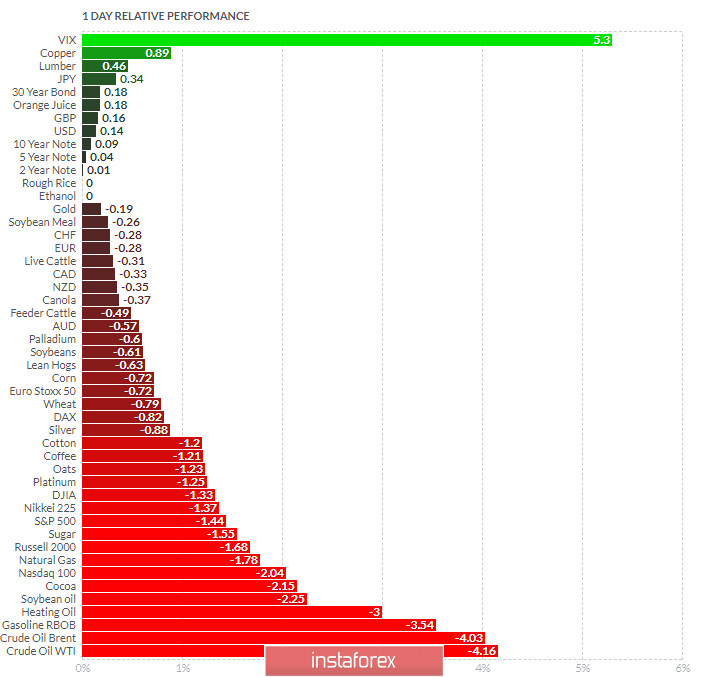

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Copper today and on the bottom Crude Oil and energry sector.

The EUR is neutral on the relative list and is waiting for the Non-Farm Employment Change numbers.

Key Levels:

Resistance: 1,1740

Support level: 1,1705

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română