The report says that the commission will use a no-deal Brexit assumption in preparing its next set of economic forecasts for the autumn. The technical assumption is that the EU and UK will conduct trade on WTO terms as of 1 January.

That sort of underscores which direction they are anticipating talks to go over the next few weeks, but then again it could just be seen as another "power play".

As I discussed in the previous review, the EUR is heading towards the cluster of the lows at 1,1700 and I would watch for selling opportunities...

Further Development

Analyzing the current trading chart of EUR/USD, I found that the trend is downside and that you should look for selling opportuntiies on the rallies

I found that breakout of the rising trendline in the background and potential for further drop.

Downward targets are set at the price of 1,1700, 1,1620 and 1,1545

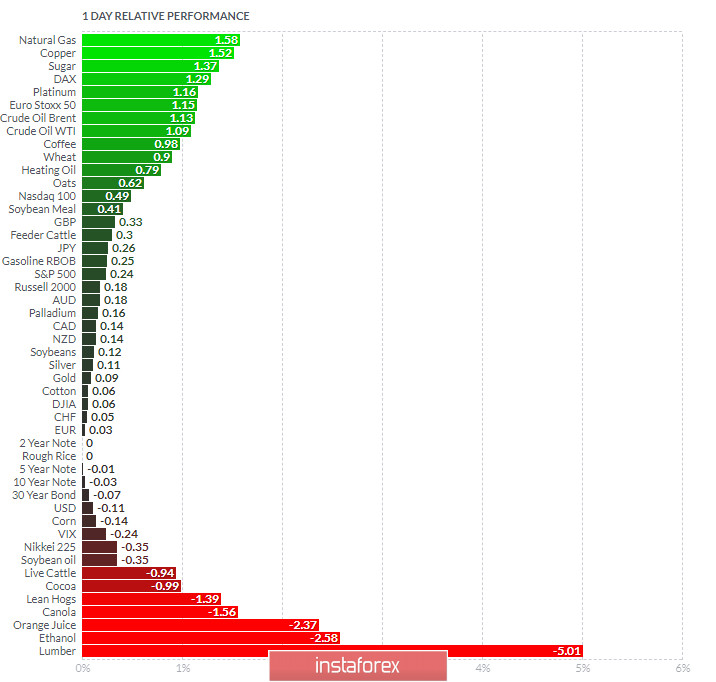

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural Gas and Copper today and on the bottom Lumber and Ethanol.

EUR is neutral today....

Key Levels:

Resistance: 1,1775

Support levels:1,1700, 1,1620 and 1,1545

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română