Prior -44

- Trends selling prices -1 vs -4 expected

- Prior -5

The slight setback here underscores that any recovery momentum among UK manufacturers remains tepid at best, and the situation may yet get worse once government stimulus starts to run its course ahead of the closing months of the year.

The CBI readings are a survey on manufacturers to rate the level of volume for orders expected during the next 3 months.

As I discussed in the previous review, the Gold managed to test my fourth target at the price of $1,905 but there is still more potetnial for the downside continuation towards the level of $1,865.

Further Development

Analyzing the current trading chart of Gold, I found that the trend is downside and the most recenetly the Gold exited from the bear flag pattern, which is good sign for further downside continuation.

Watch for selling opportunities wit hthe downward target at the price of $1,865.

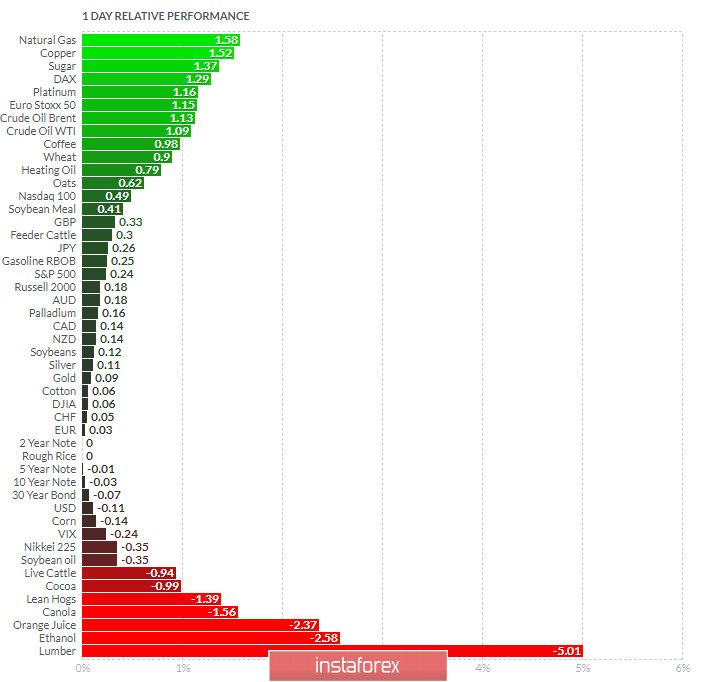

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural Gas and Copper today and on the bottom Lumber and Ethanol.

Key Levels:

Resistance: $1,920

Support levels: $1,883 and $1,865

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română