Monetary Policy Decision - 17 Sep 2020

- Prior 0.10%

- Votes 0-0-9 vs 0-0-9 expected

- Asset purchase program total £745 billion vs £745 billion expected

- Bank of England says MPC had been briefed on the the BoE's plans to explore how a negative bank rate could be implemented effectively. (seen some GBP selling on that headline)

- Total stock of asset purchases to £745 billion around the turn of the year

- Market contacts had expressed concern over recent Brexit developments

- Outlook for economy looks unusually uncertain

Further Development

Analyzing the current trading chart of Gold, I found tthat there was the rejection of the upper trendline of symmetrical triangle and there is posibility for the breakout very soon to happen.

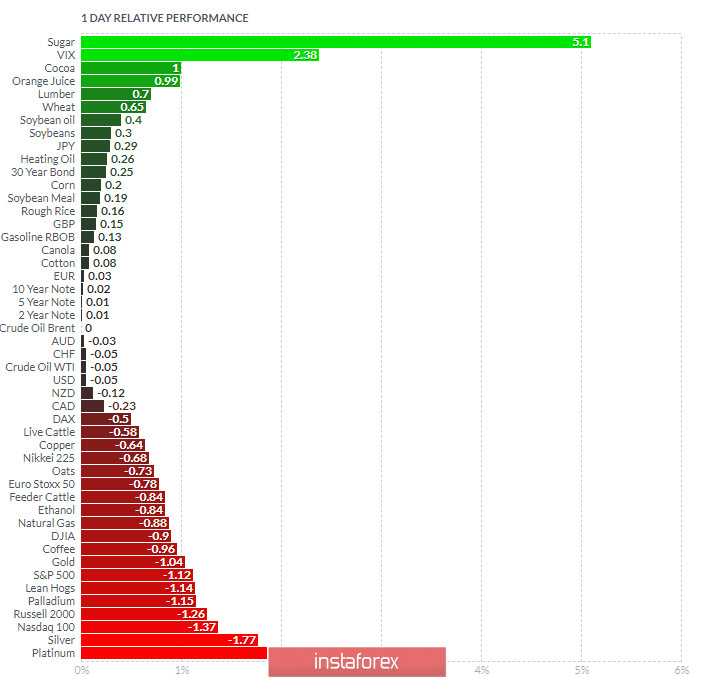

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Sugar today and on the bottom Platinum and Silver.

Key Levels:

Resistance: $1,975

Support level: $1,915

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română