Recently, investors are betting on the depreciation of the US dollar very often. This trend was caused by the extreme stimulus from the Fed. Experts believe that withdrawal of money from risk assets may trigger the closure of a large number of short positions on the US currency, which will strengthen it and put serious pressure on oil prices.

During the pandemic, the DXY dollar index fell by 9.5%. This was facilitated by a flurry of liquidity from the Fed and increasing investor fears about the US budget deficit. In any case, oil prices are under pressure because selling of the US dollar has become a generally accepted strategy.

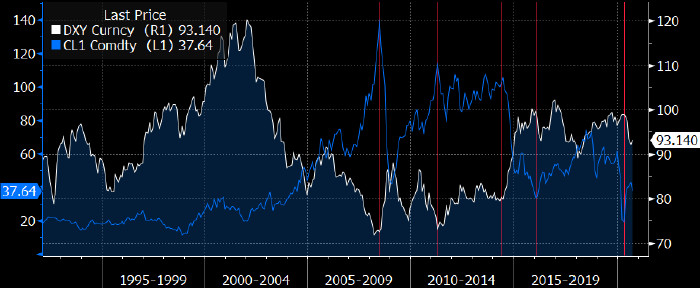

According to the chart below, we can say that the rise in the US dollar rate led to the oil depreciation.

What can lead to a sharp rise in the US dollar? In case of an even greater increase in the number of coronavirus cases or worsening geopolitical tensions, investors will be forced to sell risky assets and go to "quality", which will provoke a cascade of closing short positions on the American currency. Accordingly, the US dollar will rush up.

Today, oil prices have dropped once again. November's Brent futures fell by 0.43% to trade at $39.66 per barrel, and October's WTI futures decreased by 0.4% to settle at $37.18 per barrel. This indicates the end of the growth phase. Moreover, there is still the danger of another collapse in global oil demand amid new outbreaks of COVID-19. Every day more and more countries report a rise in the number of people suffering from the Chinese virus and the reinstatement of quarantine measures. This will certainly have a negative impact on oil prices.

Moreover, the OPEC + oil deal is also under pressure. The Iraqi authorities, following in the footsteps of Saudi Arabia, will cut their oil prices for the US, Europe, and Asian markets from October by $1, $0.75, and $2.65, respectively.

Discounts indicate that there is still too much oil in the global market and customers refuse to buy it at the current prices.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română