- But Germany is convinced it is still possible

- But UK must make concessions for a deal to happen

Different day, same story. Both sides are still pushing for each other to move their red lines but until we move closer to deadline day, the pressure is yet to be truly felt.

As I discussed in the previous review, the EUR is creating drift pattern on the weekly time-frame, which is big warning for the ehaustion from buyers and potential drop yet to come.\

Further Development

Analyzing the current trading chart of EUR, I found that the buyers got exhausted in the last weeks and that there is potential for the downside movement towards the first support at 1,1700.

The stronger breakout of the 1,1700 might indicate even bigger drop towards the 1,1500 level.

Watch for selling opportunities on the rallies with short-term downside targets at 1,1700 and 1,1500

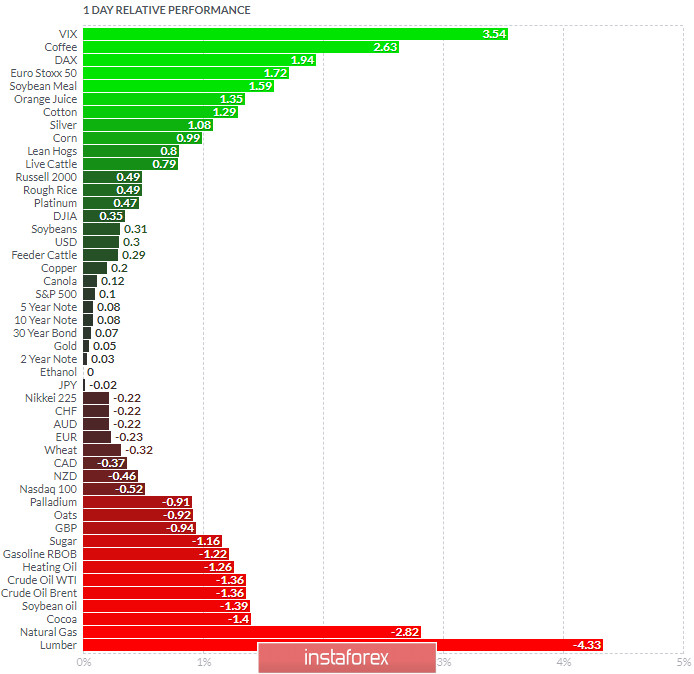

1-Day relative strength performance Finviz:

Based on the graph above I found that on the top of the list we got VIX and Coffee today and on the bottom Natural gas and Lumber.

Key Levels:

Resistance: 1,1835 and 1,1845

Support levels: 1,1700 and 1,1500

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română