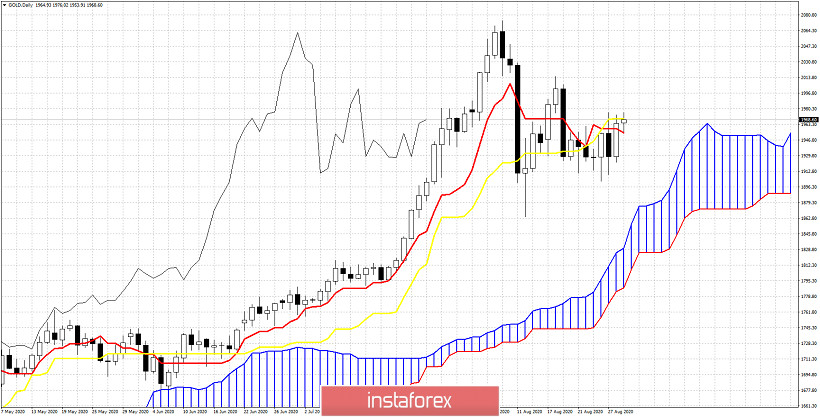

Gold price has bounced strongly off $1,900 support area but the advance has stopped at the major resistance area around $1,950-70 where we find the key indicators tenkan-sen and kijun-sen.

Gold price is above the Daily Kumo. Trend is bullish. Price is above the tenkan-sen (red line indicator) and is challenging the kijun-sen (yellow line indicator). The tenkan-sen is below the kijun-sen and we need to see the tenkan-sen cross above the kijun-sen to get another bullish signal. Price also needs to push above the kijun-sen (yellow line indicator) to have a bullish signal. The Chikou span (black line indicator) is above the candlestick pattern and this confirms bullish trend. A rejection at current levels will be a very bearish sign and could push price back to $1,900 or even lower. Bulls need to break resistance at $1,970 and stay above $1,950.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română