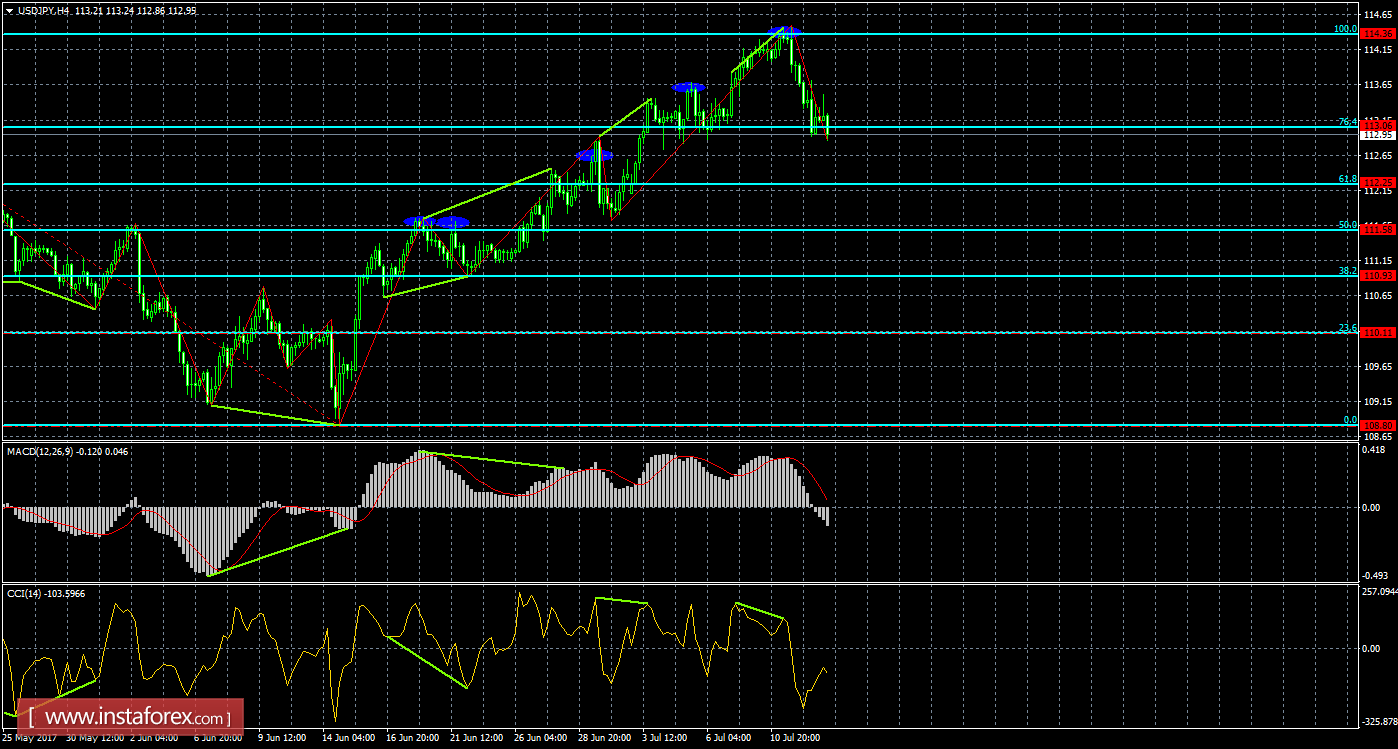

4h

As the price rebounded from the correction level of 100.0% - 114.36 and formed a bearish divergence, the USD/JPY moved downwards through the correctional level of 76.4% - 113.06.

A reversal from the Fibo level of 76.4% allows traders to expect a rally in favor to the US dollar and a slight increase towards the correction level of 100.0%. Prices consolidated under the Fibo level of 76.4% will work when the correction level of 61.8% declined. There are no emerging divergences on July 13.

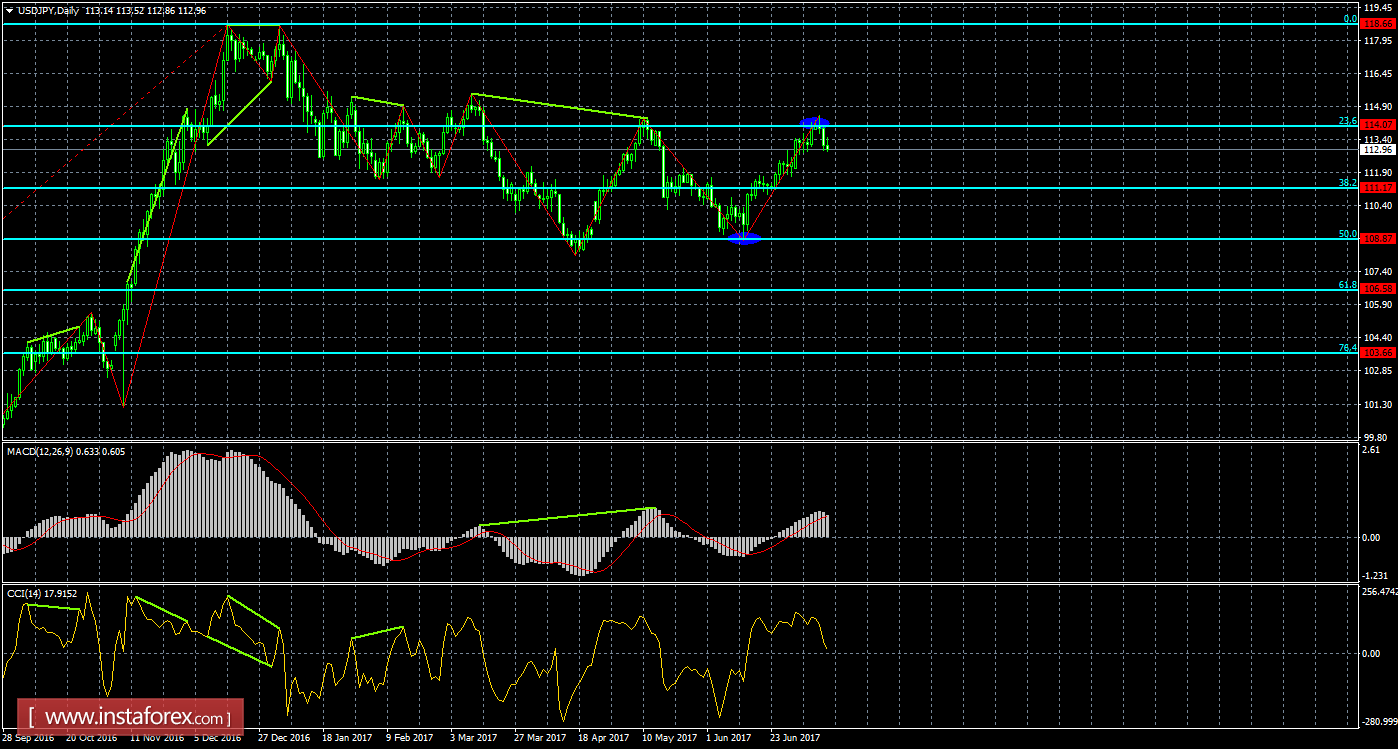

Daily

As shown in the 24-hour chart, the pair pulled back from the correction level of 23.6% to 114.07 which could lead to a reversal towards the Japanese currency. This also resulted in a downtrend towards the direction of the Fibo level began 38.2% - 111.17. There are no emerging divergences seen in any indicator. The prices are fixed above the correction level of 23.6% which is favorable to the US currency and the growth continues through the Fibo level 0.0% - 118.66. The pair's retracement from the correction level of 38.2% will work similarly with an earlier uptrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română