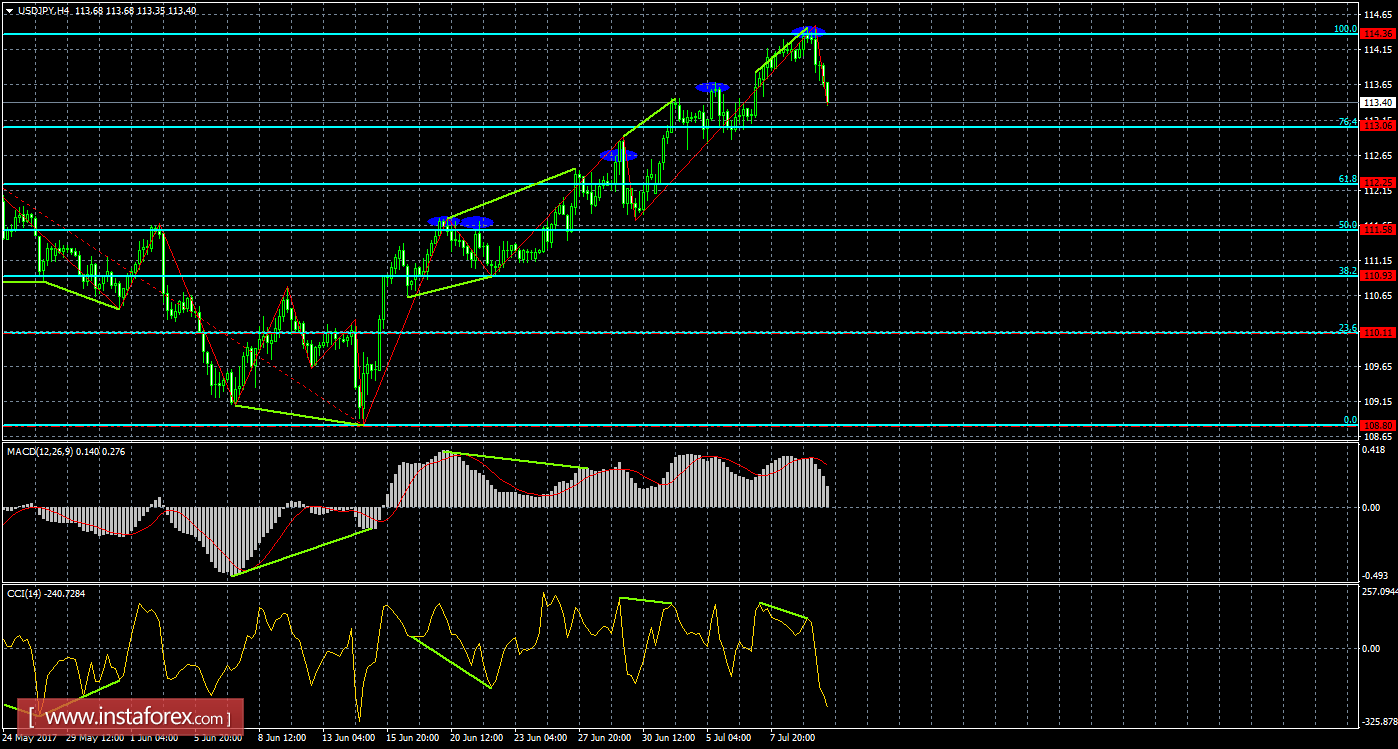

4h

After the currency pair USD / JPY rebounded from the correction level of 100% to 114.36 and the formation of a bearish divergence, the quotes executed a reversal in favor of the currency of Japan and began to fall in the direction of the correctional level of 76.4% - 113.06. Bearish divergence in the CCI indicator: The last peak of quotations turned out to be higher than the previous one, and the analogous peak of the indicator is lower than the previous one. The retracement of the rate from the Fibo level of 76.4% will allow us to expect a turn in favor of the US currency and some growth towards the correction level of 100.0%, while consolidation under the Fibo level of 76.4% will work in favor of a further fall.

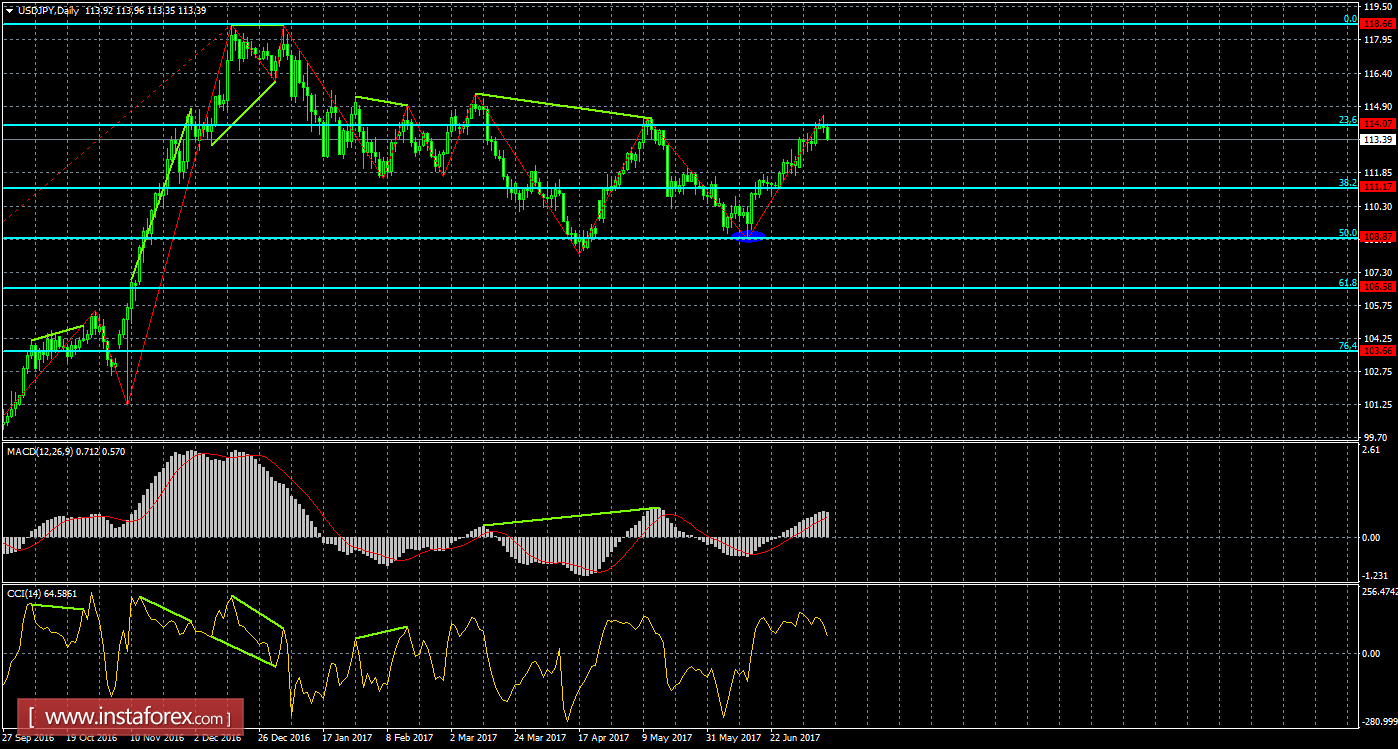

Daily

On the 24-hour chart, the pair completed the growth to the correction level of 23.6% - 114.07. On July 12, there are no visible divergences for any indicator. The pair's retracement from the Fibo level of 23.6% will allow traders to count on a reversal in favor of the Japanese yen and a slight drop towards the corrective level of 38.2% - 111.17. Fixing the quotes above the Fibo level of 23.6% will increase the probability of continuing growth towards the next correction level of 0.0% - 118.66.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română