- Prior +17.8%; revised to +20.3%

- Retail sales +1.3% vs -0.2% y/y expected

- Prior -5.1%; revised to -3.1%

Retail sales activity continues to pick up after bottoming out in April, with textiles, clothing and footwear contributing to the big beat once again. This could still be largely due to pent-up demand but regardless, is a lagging indicator since this pertains to Q2.

As I discussed in the previous review, the Gold managed to breakout the ascending triangle that I warned yesterday and almost tested my yesterday's target at $2,050

Further Development

Analyzing the current trading chart, I found that the buyers are in control but that they might be in overbought condition. Still, I see potential test of $2,050 but after the pullback first.

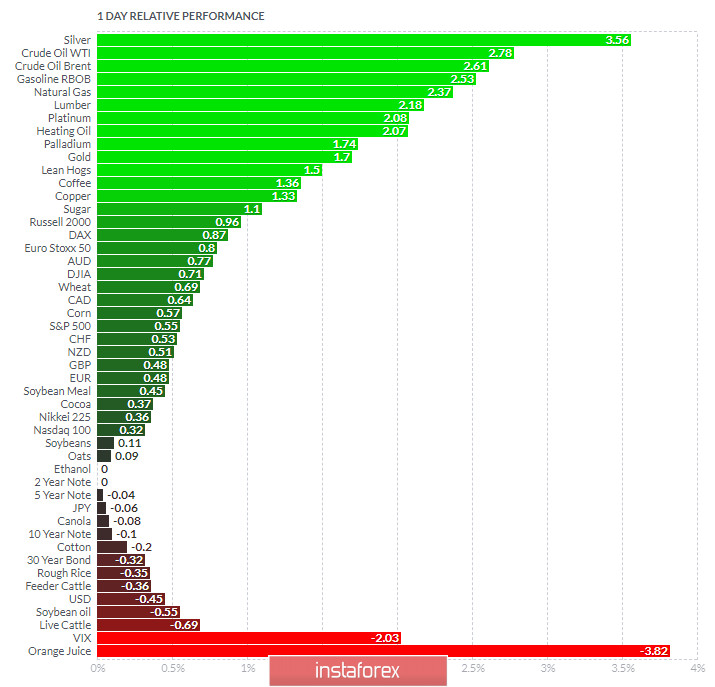

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Silver and Crude Oil today and on the bottom Orange Juice and VIX

In my opinion, The money flow is definitely today on the Metals and there is more room for the upside.

Key Levels:

Resistance: $2,050

Support level: $2,030

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română