Latest data released by Eurostat

Prior 0.6%

- PPI -3.7% vs -3.8% y/y expected

- Prior -5.0%

Producer prices improved a little once again in June but are still largely subdued relative to a year ago. The data here is a proxy for inflation pressures in any case and is a lagging indicator, so not much else to really gather from the release.

EUR/USD keeps a little firmer still just under the 1.1800 handle as the battle around key near-term levels continues on the session.

As I discussed in the previous review, the EUR managed to complete the downside correction and test our first target at the price of 1,1800 Next upward targets are set at 1,1850 and 1,1900.

Further Development

Analyzing the current trading chart, I found that the buyer took control from sellers and that based on the daily time-frame there is is potential for the upside continuation. EUR/USD still got strong upside trend in the background.

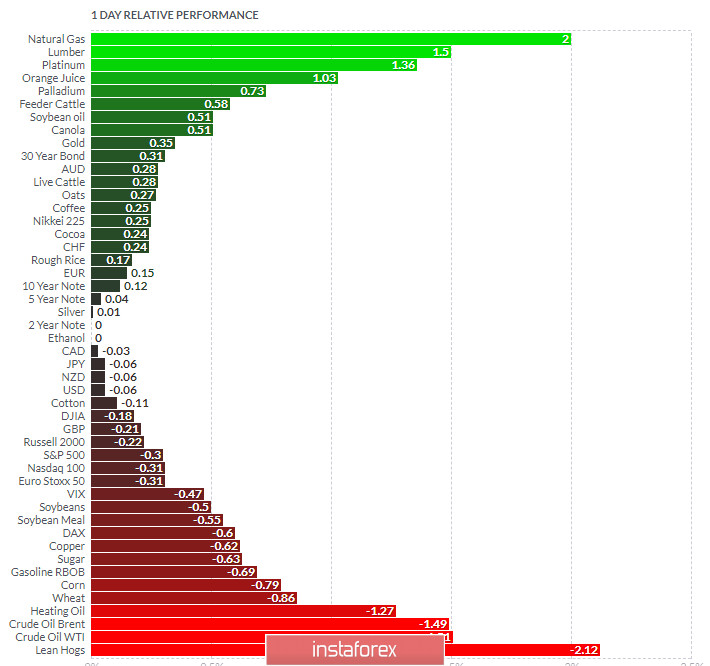

1-Day relative strength performance Finviz :

Based on the graph above I found that on the top of the list we got Nautral gas and Lumber and on the bottom of the list Lean Hogs and Crude Oil.

Key Lvels:

Support levels: 1,1767 and 1,1750

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română