The yellow metal is trading in the green and seems determined to trade higher again after the minor and temporary drop. As I said yesterday, the gold price is bullish and it could try to approach and reach the $1,981 historical high again.

The FOMC Meeting will bring volatility on gold as well later today, so you should be careful not to take a serious hit from a sharp move. Gold is trading at $1,957 level and is located in the buyer's area.

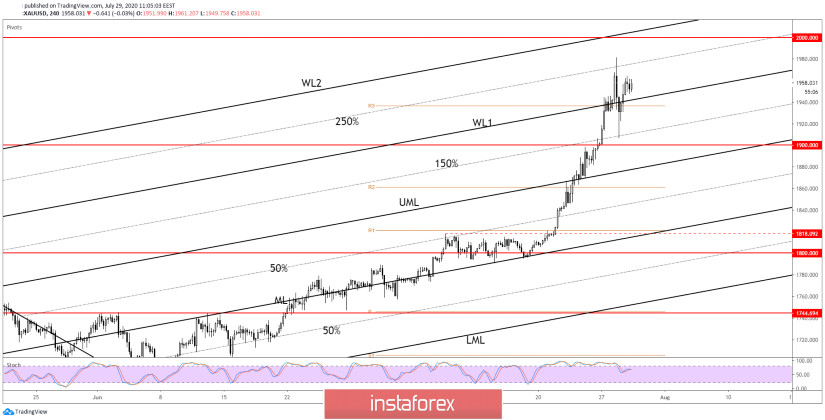

Gold has decreased, but this was only a false breakdown below the R3 ($1,936) and below the first warning line (WL1), so the bullish bias is intact. As I said yesterday, a minor drop could give us a chance to go long again because it was really hard that the price will start a major corrective phase after yesterday's development.

The outlook is bullish and it could approach and reach fresh new highs if it stays above the warning line (WL1). The next target remains at the 250% Fibonacci line, and at the $1,981 all-time high.

- Gold Trading Tips

Gold could jump higher if the FOMC Press Conference reveals the dovish stance. You can search for long opportunities from above the warning line (WL1), a retest or a false breakdown with great separation below this dynamic support will signal a bullish momentum.

The $2,000 psychological level and the second warning line (WL2) could be used as potential targets as well if the price stays above the WL1.

If you want to sell gold, you should wait for a major reversal pattern around the near-term resistance levels, or for a valid breakdown below the $1,900 and below the upper median line (UML).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română