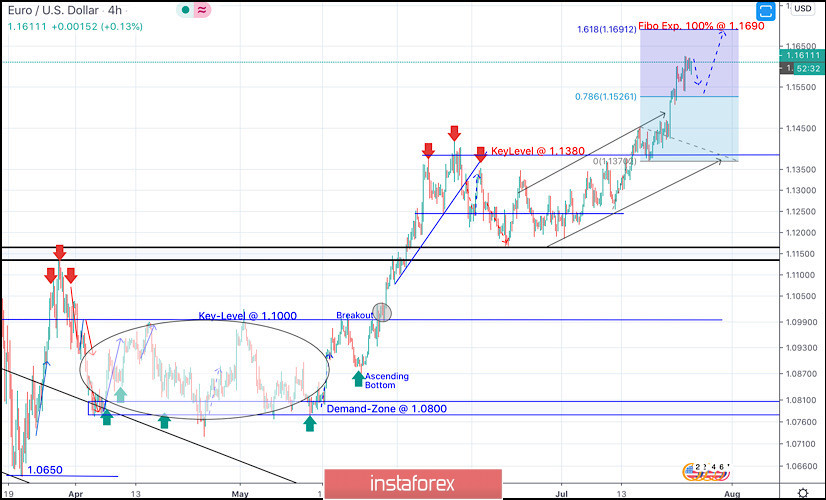

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the established bottom around 1.0650.

Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000.

On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term.

Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1150 then 1.1380 where another sideway consolidation range was established.

Hence, Bearish persistence below 1.1150 (consolidation range lower limit) was needed to enhance further bearish decline. However, the EURUSD pair has failed to maintain enough bearish momentum to do so.

Instead, the current bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1520 (Fibonacci Expansion 78.6% level) which failed to offer sufficient bearish pressure.

That's why, further bullish advancement is expected to pursue towards 1.1690 (Fibonacci Expansion 100% level).

Trade recommendations :

Conservative traders should for the current bullish movement to pursue towards the price zone around 1.1690 where any signs of bearish rejection should be considered as avalid SELL signal.T/P levels to be located around 1.1530 and 1.1450 while S/L to be placed above 1.1750 to minimize the associated risk.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română