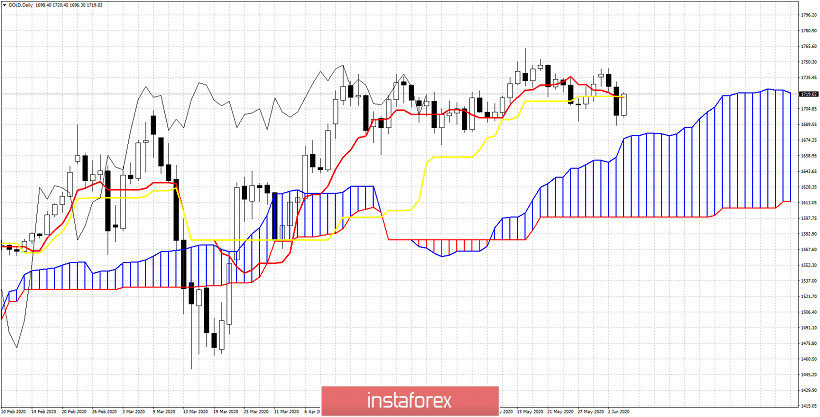

Gold price is bouncing strongly once again towards $1,720. Price has held for another week the $1,700 level unless bears take the upper hand tomorrow. Bulls are trying to recapture the tenkan-sen and kijun-sen pivot point intersection.

Gold price is approaching the 61.8% Fibonacci retracement of the recent decline. The 61.8% Fibonacci level is at $1,722. As one can clearly see the area of $1,700-$1,725 is a very important area for Gold. Price has been mostly moving around it since early April. Focusing on the bigger picture, the levels to watch are 1.785-90 (need to break $1,745 for this target to be achieved) and $1,670-40 (need $1,700 to break on a weekly basis).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română