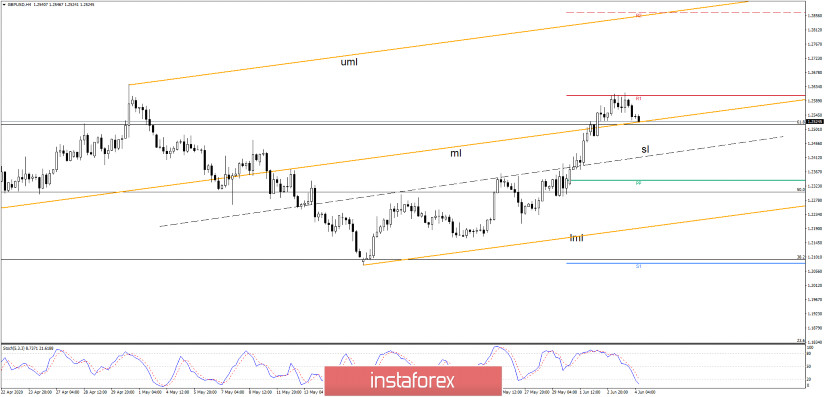

GBP/USD is trading in the red right now, the retreat is normal after the impressive bullish movement. The pair is trading at 1.2521 level, it was rejected by a strong static upside obstacle, and now is challenging the near-term support.

The USDX's rebound has lifted the dollar, that's why GBP/USD is losing ground in the short term. However, the price maintains a bullish bias, despite the minor drop, the current drop could bring a great long opportunity.

GBP/USD has found strong resistance at the R1 (1.2605) level and now is pressuring the 61.8% retracement level and the median line (ml) of the orange ascending pitchfork. A valid breakdown below these support levels will suggest a drop towards the inside sliding line (sl) of the ascending pitchfork.

Technically, the current drop is natural, the price always comes back to test and retest the median line (ml). A rejection or a false breakdown with a huge separation will signal a further increase.

Still, a great buying opportunity will be signaled by a valid breakout above the R1 (1.2605), the next upside targets are seen at the upper median line (UML) and at the R2 (1.2865) level.

- GBP/USD Trading Tips

Long above 1.2614 former high with targets at the upper median line and at the R2 (1.2865) level. Also, a false breakdown and a rejection from the median line (ml) along with the Stochastic oversold could bring a long signal sooner.

GBP/USD is bullish as long as it is traded above the inside sliding line (sl) of the ascending pitchfork. The sliding line (sl) could offer a long opportunity as well.

The pair is bullish, so I believe that only a valid breakdown below the PP (1.2340) and below the 50% level will announce a larger drop. In the short term, we could sell GBP/USD if it closes below the median line (ML) and if it comes back to test and retest this broken dynamic support.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română