Overview:

- British Pound against the US Dollar.

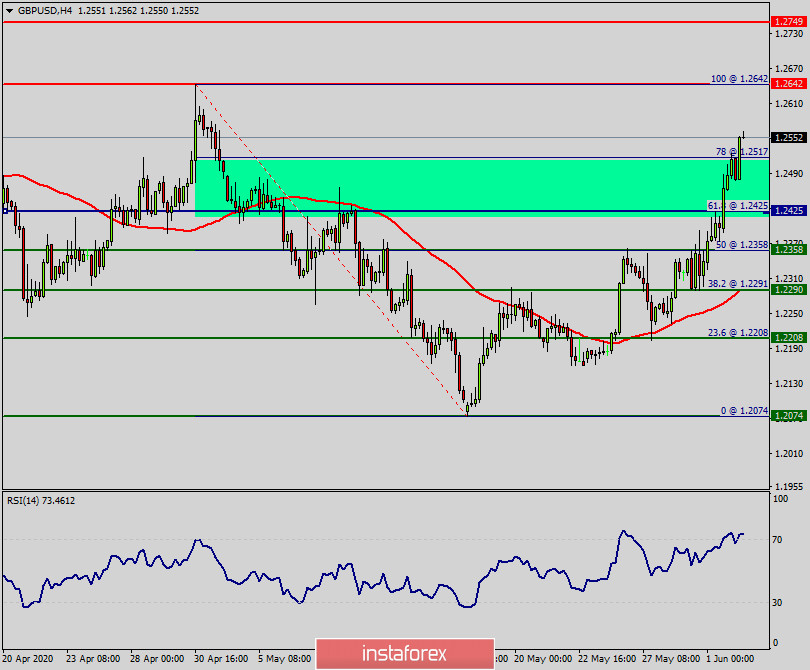

- H4 chart.

- Pivot: 1.2425.

The GBP/USD pair has long been regarded as one of the least volatile currency pairings on the global forex market. Not long ago, the GBP/USD pair experienced several fluctuations with Britain's exit from the European Union and the last problems of the Coronavirus disease (COVID-19).

The GBP/USD pair broke resistance which turned to strong support at the level of 1.2425 yesterday. The level of 1.2425 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as major support today.

The Relative Strength Index (RSI) is considered overbought because it is above 70. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). This suggests the pair will probably go up in coming hours. RSI indicator is still at positive and it does not show signs of a trend-reversal.

Accordingly, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended above 1.2425 with the first target at the level of 1.2642. From this point, the pair is likely to begin an ascending movement to the point of 1.2642 and further to the level of 1.2749.

The level of 1.2642 will act as strong resistance and the double top is already set at the point of 1.2642. Major resisance sets at the level of 1.2749.

Plan of trades with the GBP/USD forecast and key pivot points data and support and resistance levels.

- Resistance 2: 1.2749.

- Resistance 1: 1.2642.

- Pivot point: 1.2425.

- Support 1: 1.2358

- Support 2: 1.2291.

Forecast:

- The price is expected to reach a high once again. It is rather gainful to buy at 1.2445 with the targets at 1.2642 and 1.2749. So, it is recommended to place take profit at the price of 1.2749 this week. On the other hand, if a breakout happens at the support level of 1.2445, then this scenario may become invalidated. but overall I still prefer a bearish scenario at this phase

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română