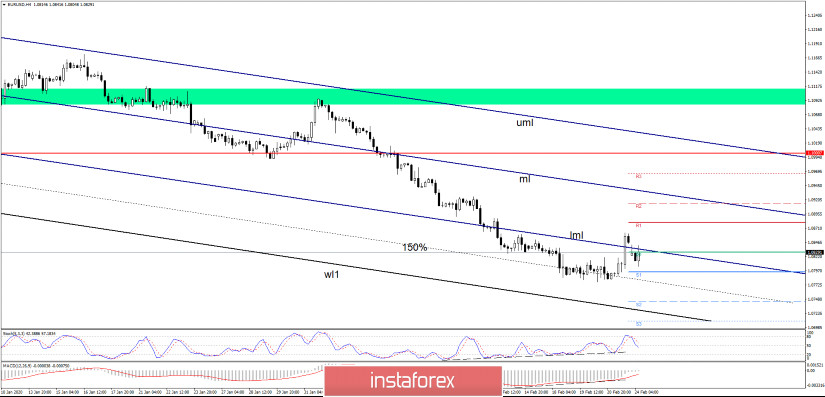

EUR/USD is fighting hard to gain momentum and to stabilize above the resistance area. We may see a further increase if the price closes the gap down and if the USDX drops deeper in the short term. The pair has jumped higher in the previous week, but the reversal is still uncertain as the price is trading below some important resistance levels.

EUR/USD is trading right below the weekly Pivot Point (1.0829) level and below the lower median line (lml), unfortunately the pair wasn't able to hold above this resistance area and to confirm a potential leg higher. I believe that a valid breakout above the 1.0829 static resistance and above lower median line (lml) could trigger an important rebound.

EUR/USD could drop sharply if the USDX resumes the upside movement and as long as it is trading below the mentioned resistance levels. The pair was expected to increase as the MACD and Stochastic indicators have signaled a bullish divergence. EUR/USD has found a temporary support on the 150% Fibonacci line, the failure to stabilize below the S1 (1.0795) has signaled a potential upside momentum, but the today's gap could invalidate it.

- Trading Tips

A drop below S1 (1.0795) level will announce a further drop in the upcoming period, while a valid breakout and a consolidation above PP (1.0829) level and above the lower median line (lml) could validate a potential increase towards R1 (1.0880), R2 (1.0914) and towards the median line (ml) which acts like a magnet.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română