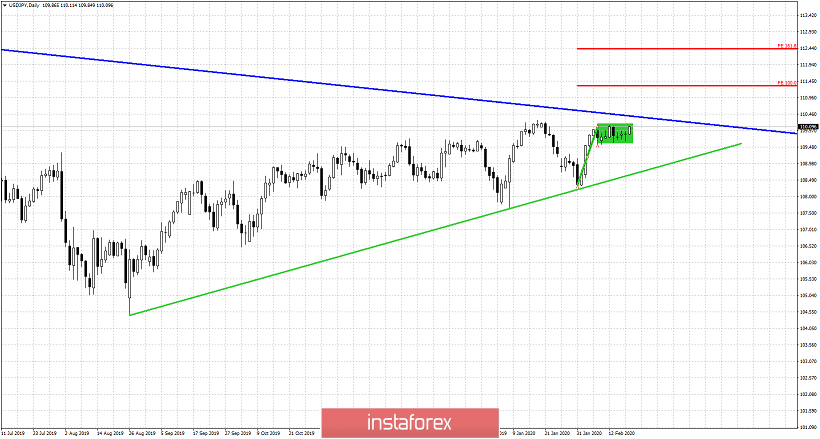

USDJPY is trading below key long-term resistance at 110-110.30 as we have been saying in previous posts. However in the short-term price has formed a bullish flag pattern that bears should not ignore.

Blue line -long-term resistance trend line

USDJPY is again at 110. This is important long-term resistance levels and bulls need to be cautious. So far price action has been supportive of the bullish scenario. The bullish flag formation if validated with a break out above 110.30 could push price towards 111.30-112. So far price has not broken any key support level. After the latest upward move from 108.25, price has been stalling and mainly moving sideways. Relieving the price from overbought conditions.

Green line - long-term support trend line

Red lines - potential upside targets

If price manages to break above 110.30 and hold above it, we should see price move towards our red line targets which are Fibonacci expansions of the last leg up from 108.25. So our first target would be around 111.30 and next at 112.40. The most important obstacle for bulls is the key downward sloping trend line. So far USDJPY has not managed to break above it. Despite the numerous rejections, price has also not broken any key support level yet. So we remain focused here as a big move towards 112 or towards 106 could come over the coming weeks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română