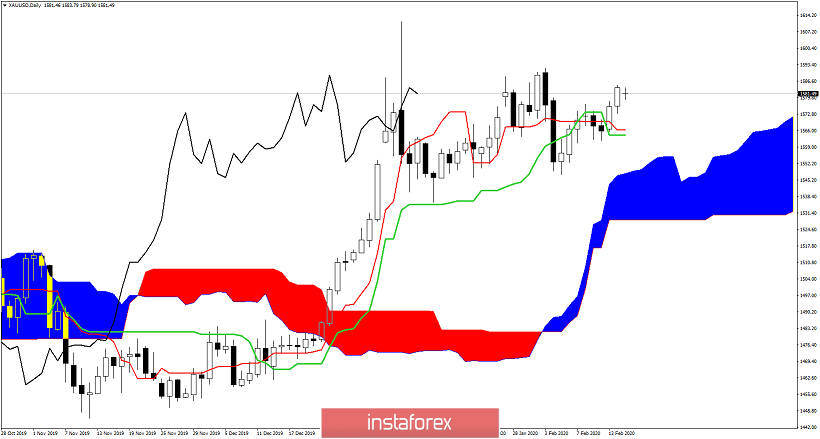

Gold price has recaptured the important resistance level of $1,575 and has so far canceled our view for a pull back towards $1,500. Short-term trend is bullish and the Ichimoku cloud indicator confirms that also.

Green lines - bullish channel

Gold price is forming a short-term bullish channel. Price has broken above the 61.8% Fibonacci retracement level and is now challenging the 78.6% retracement. As long as price is above $1,563 short-term trend will remain bullish.

Price remains above the Kumo (cloud) and is now once again above both the tenkan- and kijun-sen indicators. If the green indicator (tenkan-sen) turns above the red indicator (kijun-sen) then we will have a strong bullish signal. Support by both the tenkan- and kijun-sen is found at $1,563-66. Holding above this level is key for a move towards $1,600 and higher.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română