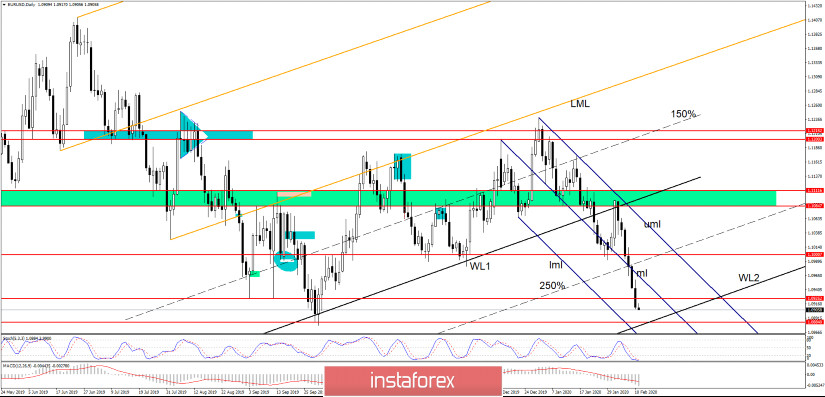

First of all, EUR/USD is under massive selling pressure and it seems unstoppable on the Daily chart. It is trading at 1.0907, below the 1.0925 static support, the next downside target is seen at 1.0884.

USDX impressive rally has forced the EUR/USD pair to reach new lows, the dollar index could climb even higher, that's why the currency pair is somehow expected to drop deeper on the short term. ECB President Lagarde and Fed Chair Powell speeches could shake the market later today, you should be ready for some volatility and for aggressive movements.

EUR/USD continues its decline after the aggressive breakdown through the 250% Fibonacci line and below the median line (ml) of the descending pitchfork. The pair could still be attracted by the second warning line (WL2) of the former ascending pitchfork.

We have a bearish bias as long as the price is trading below the median line (ml) of the descending pitchfork, 1.0884 represents a critical static support. EUR/USD could approach and reach the lower median line (lml) if the USDX surpasses the 99.00 psychological level.

Stochastic indicates an oversold situation, but we don't have any reversal pattern that could signal a potential upside movement.

- Conclusion

It will be very important to see how EUR/USD will react near 1.0884 level and when it will touch the second warning line (WL2). A valid breakdown will signal a further drop, while a false breakdown (Pin Bar, Bullish Engulfing, etc.) could signal that the downside movement is complete and that we may have another leg higher.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română