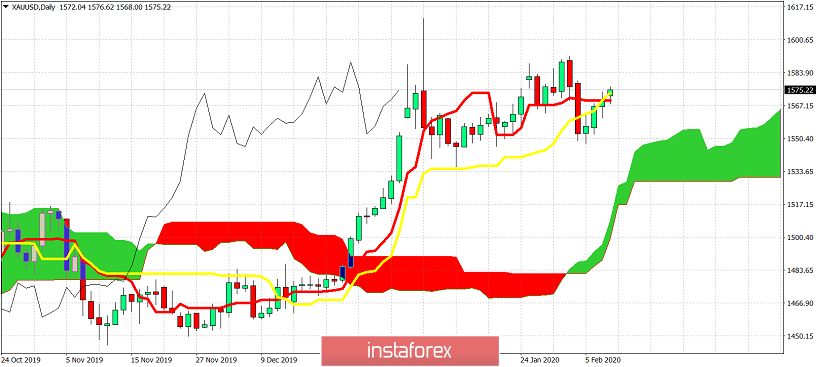

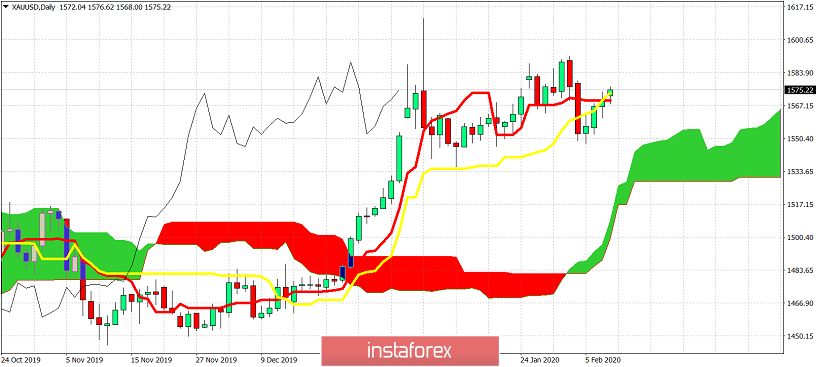

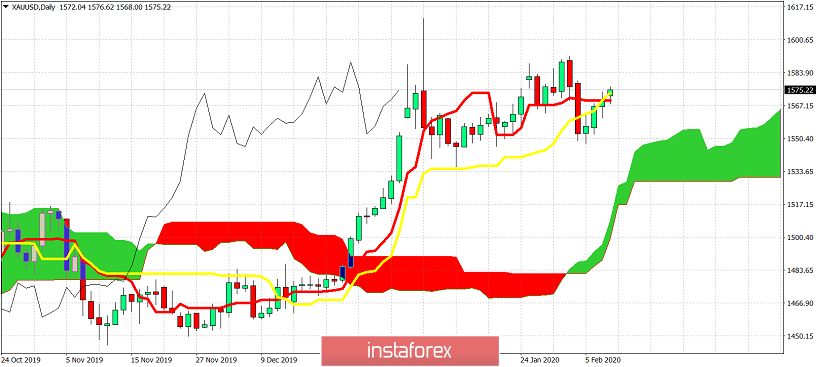

Gold price is challenging important short-term resistance area of $1,570-75. We have a weak sell signal as the tenkan-sen has crossed below the kijun-sen and at the same time price is below the kijun-sen.

Daily trend is bullish as price is above the Daily Kumo. So far we only have a weak signal but price is still between the kijun-sen (yellow line indicator) and the tenkan-sen (red line indicator). Gold has many chances of a rejection at current levels so bulls need to be very cautious. A daily close below $1,567 would be a first sign of rejection. If bulls manage to hold above $1,570 they will then try to recapture $1,580.

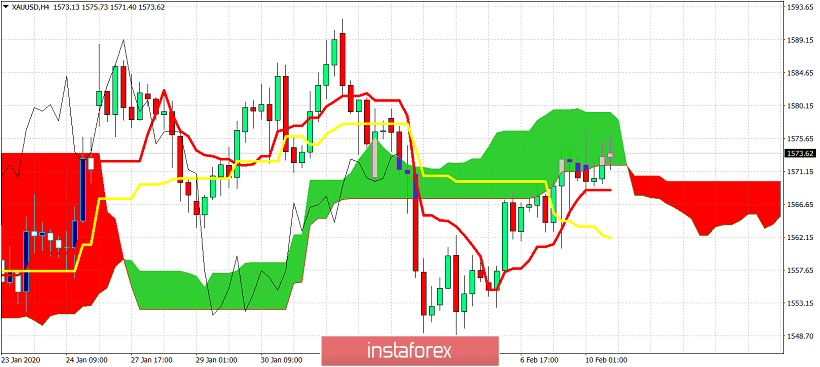

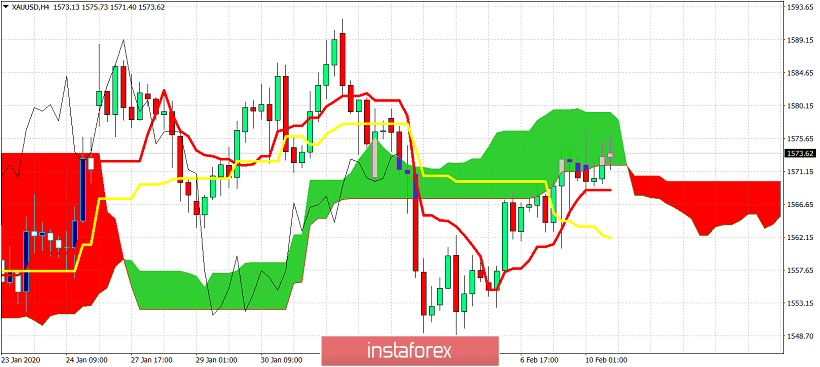

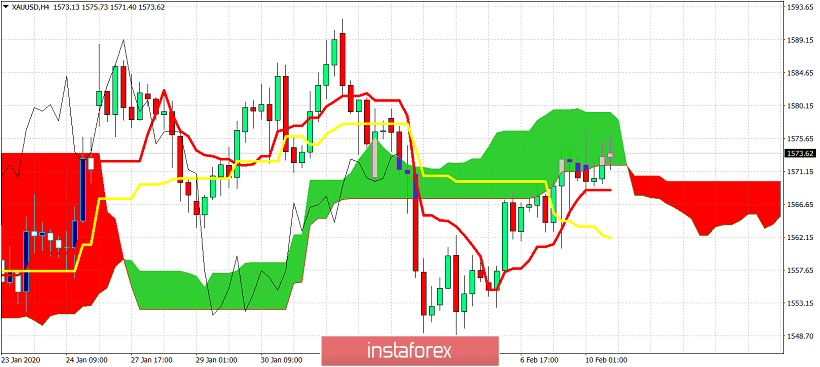

At $1,580 we find the upper cloud boundary of the 4 hour Ichimoku cloud. This is important short-term resistance. In the 4 hour chart we also get confirmation of the importance of the $1,567 short-term support as this is where we find the tenkan-sen support. Below that we find $1,562 support by the 4 hour kijun-sen. So far price continues to make higher highs and higher lows since $1,547 low. I will get a stronger sell signal on a break below $1,567 and that could imply more downside to come.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

Relevance until

Relevance until