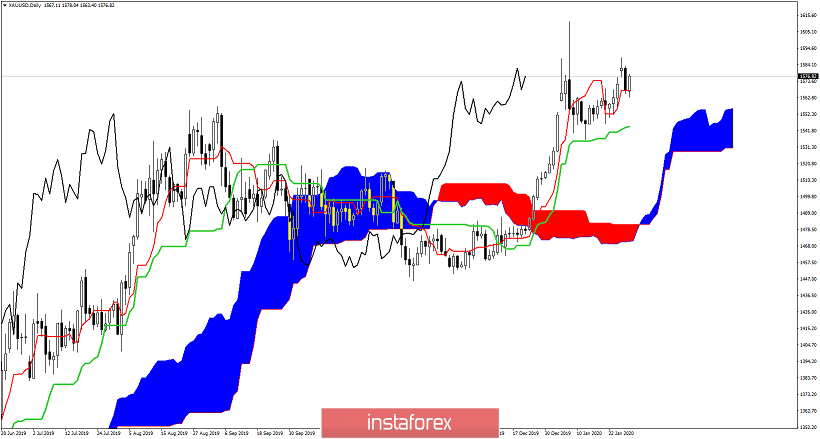

Gold price remains supported despite the pull back from $1,588 to $1,563. Price continues to make higher highs and higher lows after bottoming back on January 14th and is trading inside a bullish channel.

Green lines - bullish channel

Red lines - Fibonacci extensions

Gold price has so far managed to reach our first target which was at $1,578. Price since then pulled back towards $1,560 and is now bouncing off the lower channel boundary. We might next see the second Fibonacci extension target at $1,599. The oscillators are not in overbought territory and both an positive slope. This shows that there is potential to the upside.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română