Overview:

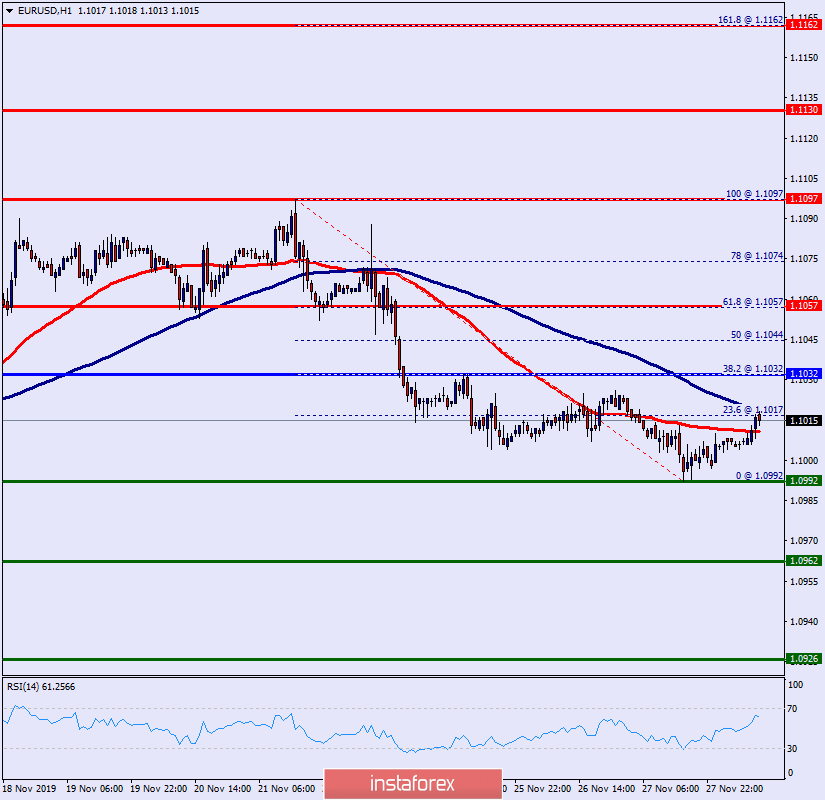

The EUR/USD pair continues to move downwards from the level of 1.1057. This week, the pair dropped from the level of 1.1057 to the bottom around 1.0992. But the pair has rebounded from the bottom of 1.0992 to close at 1.1020.

Today, the first resistance level is seen at 1.1032 followed by 1.1057, while daily support is seen at the levels of 1.0992 and 1.0962.

According to the previous events, the EUR/USD pair is still trading between the levels of 1.1057 and 1.0962. Hence, we expect a range of 95 pips in coming hours.

The first resistance level is currently seen at 1.1032, the price is moving in a bearish channel now.

Therefore, if the EUR/USD pair fails to break through the resistance level of 1.1032, the market will decline further to 1.0992. This would suggest a bearish market because the RSI indicator is still in a negative area and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 1.0962 in order to test the second support (1.0962).

The level of 1.0962 is a good place to take profits. Moreover, the RSI is still signaling that the trend is downward as it remains strong below the moving average (100). This suggests that the pair will probably go down in coming hours.

However, the 1.0962 mark remains a significant support zone. Thus, the trend will probably rebound again from 1.0962 level as long as this level is not breached.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română