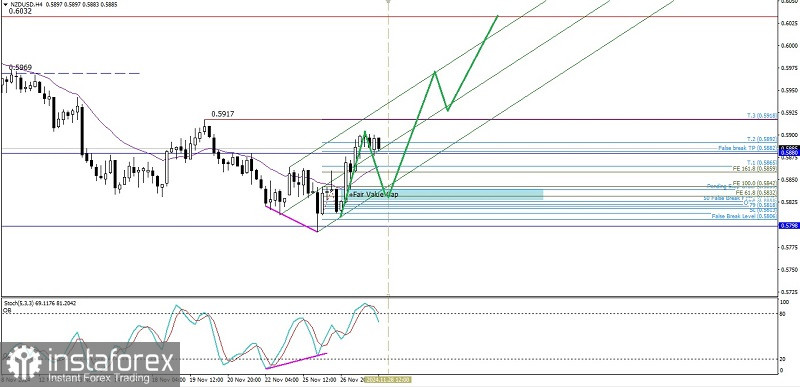

If we look at the 4-hour chart of the NZD/USD commodity currency pair, it appears that there is a deviation between the Kiwi price movement and the Stochastic Oscillator indicator and the price movement moves harmoniously in the Bullish Pitchfork channel, especially with the price movement moving above the EMA (21) which has a slope that dives upwards, it seems that the NZD/USD is strengthening but it must also be anticipated because currently the Stochastic Oscillator indicator is above the Overbought level and has returned to below the 80 level and the Kiwi has failed to touch the upper line level of the Bullish Pitchfork channel (Hagopian principle) then in the near future there is also the potential for a weakening correction to occur where the Kiwi will try to test the support area level formed from the Bullish Fair Value Gap, approximately around the 0.5832 level. What is important is that as long as the weakening correction does not break and close below the 0.5813 level, the NZD/USD still has the potential to strengthen and rise where the 0.5917 level is the main goal and if this level is successfully broken and closed above it, the Kiwi will continue to strengthen to the Upper Line Bullish Channel Pitchfork level and/or 0.6032.

(Disclaimer)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română