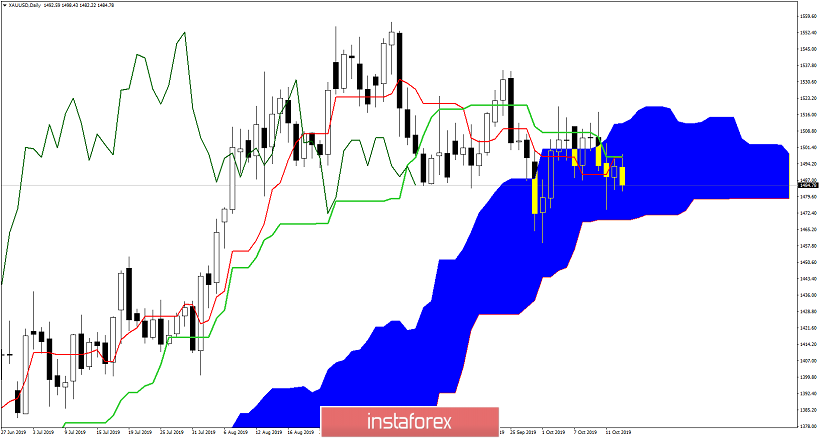

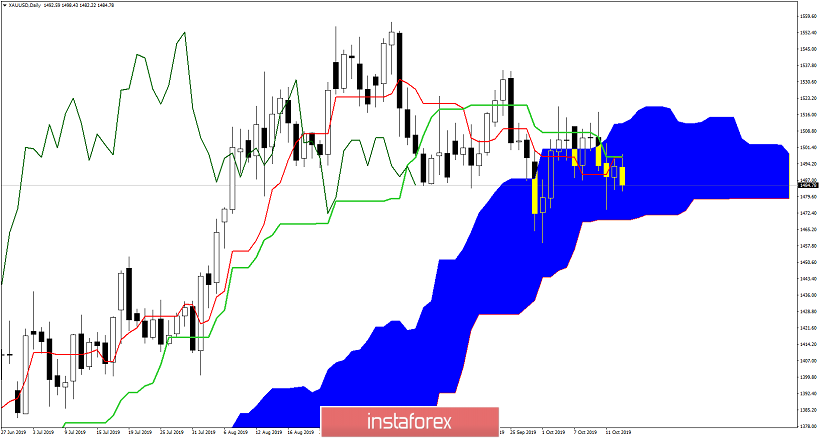

Gold price could not hold above $1,500 and combined with the inability to break the $1,525-35 resistance has lead to another pull back below $1,500. in previous posts we noted the important top that has most probably been formed and that Gold is vulnerable to a move towards $1,440-$1,400.

In Ichimoku cloud terms, Gold price in the Daily chart is in neutral trend and has already given a weak bearish signal. The weak bearish signal was given once the tenkan-sen (red line) has crossed below the Kijun-sen (green line). Trend has turned neutral as price has entered the Kumo (cloud). Breaking below the Kumo (lower boundary at $1,469) will turn the trend to bearish. With a weak bearish signal, with price staying below $1,525-35 and the overbought RSI turning lower as we have shown in previous posts, the chances favor a bearish move lower towards $1,400-$1,440. As long as price is below $1,525-35 resistance this is our preferred scenario.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română