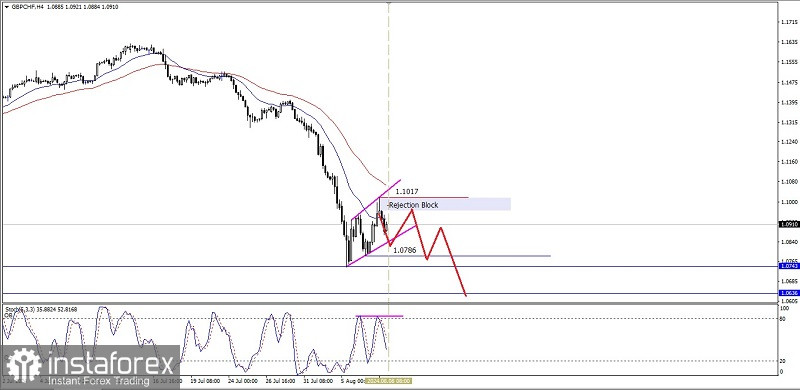

From what we can see on the 4-hour chart of the GBP/CHF cross currency pair, there are several interesting things. First, the EMA 20 intersects downwards from the EMA 50. Second, the Double Top pattern appears in the Stochastic Oscillator indicator. On the contrary, the GBP/CHF price movement forms a Higher - High and third, the strengthening correction that occurs actually forms an Ascending Broadening Wedge pattern where these three things indicate that in the near future GBP/CHF has the potential to weaken down to the 1.0786-1.0743 area level. If this area level is successfully broken downwards, then GBP/CHF will continue to weaken to the 1.0636 level. However, if on its way to these levels, there is suddenly a strengthening correction again, especially if it successfully breaks above the 1.1017 level, then all the weakening continuation scenarios that have been described previously will be invalid and canceled by themselves.

(Disclaimer)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română