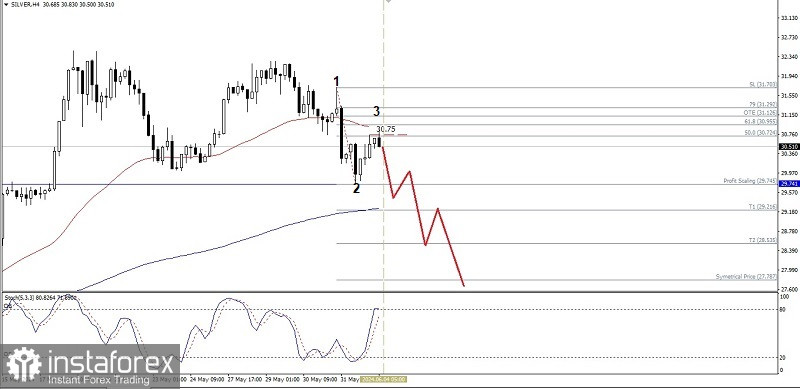

On the 4-hour chart of the Silver commodity asset, even though the 50 EMA is still above the 200 EMA, which indicates that it is in a Golden Cross condition, which means buyers are still dominant in this commodity asset, however, the appearance of a Bearish 123 pattern which is followed by an Overbought condition on the Stochastic Oscillator indicator gives an indication that In the near future, Silver has the potential to be corrected down to level 29,745 and if this level is successfully broken downwards then Silver has the potential to continue its weakening again to level 29,216 as the main target and the level area 28,535-27,787 if the momentum and volatility are supportive but if it is on its way to At these target levels, Silver suddenly returns to its initial bias, especially if it succeeds in breaking above the 31,292 level, then all the weakening correction scenarios that have been described previously will become invalid and automatically cancel itself.

(Disclaimer)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română