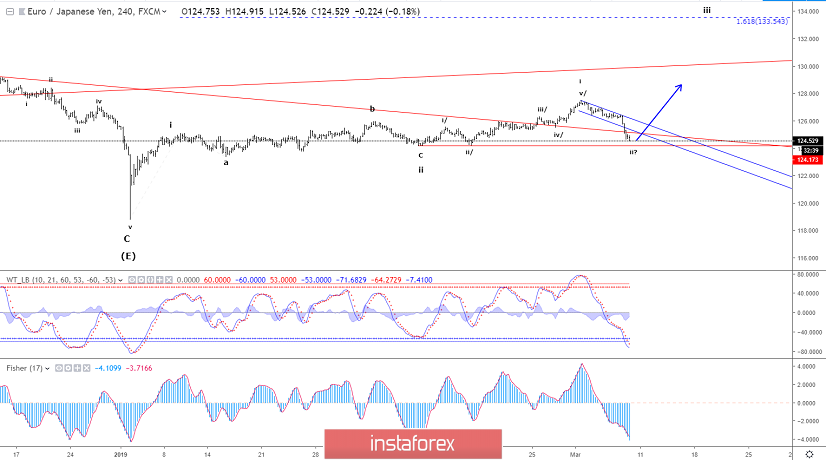

A very dovish ECB meeting drove the EUR lower yesterday. The clear break below 125.98 invalidated the bullish count and we have been back to the drawing-board to look at the alternate scenarios.

Support at 124.17 is the pivot-point. As long as the price stays above 124.17 we could see renewed strength for a push higher to 127.50 and above. Under this scenario, we will need a break above minor resistance at 124.80 and more importantly a break above 125.05 to confirm the next push higher.

If, however the pivot-point at 124.17 is broken that will shift the view towards a bearish case and call for more downside pressure towards 123.15 and possibly even closer to 122.10.

R3: 125.34

R2: 125.02

R1: 124.80

Pivot: 124.17

S1: 123.76

S2: 123.37

S3: 123.15

Trading recommendation:

Our stop at 125.75 was hit for a 110 pips profit. We will re-buy EUR upon a break above 124.80 and place our stop at 124.10.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română