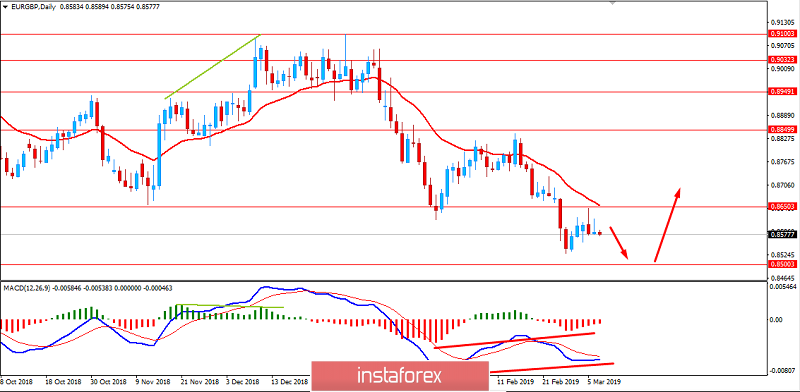

EUR/GBP has been impulsive with the bearish momentum recently. The price retraced and retested the 0.8650 resistance area with a daily close. Ahead of BREXIT, while the eurozone is facing a slowdown, GBP is currently gaining certain momentum.

The Bank of England is closely monitoring Brexit developments before it ventures into a change in interest rates. Besides, the BoE needs to update inflation and economic growth forecasts. According to rate-setter Michael Saunders, inflation is well-behaved and economic growth is modest, but a no-deal BREXIT is sure to affect the growth in a significant way. Amid the current economic conditions, if the UK Prime Minister manages to nail down a divorce deal with the EU, there are certain things which will bring in immediate changes, including borrowing costs. Great Britain is expected to leave the EU on March 29th. However, the question is till open whether the departure will take place with or without a deal. Besides, there is a growing likelihood that Brexit could take place with a delay. The UK is expected to scrap 80-90% of tariffs on imported goods if it leaves the EU with a deal, excluding certain sectors like cars, meats, and textiles.

GBP has been the stronger currency in the pair recently despite downbeat economic reports published recently. Today Halifax HPI report was published with an increase to 0.1% from the previous negative value of -2.9%.MPC Member Tenreyro is going to speak about the key interest rate and future monetary policies. The speech is expected to be indecisive and neutral ahead of BREXIT this month.

On the other hand, the eurozone is going through a serious economic slowdown. Thus, the ECB is widely expected to leave the key policy rate at a record low. Today, ECB President Mario Draghi will hold a closely watched press conference after the Main Refinancing Rate decision which is expected to be left unchanged at 0.00%. At the press conference, the ECB leader is likely to present the updated forecast on economic growth and inflation. If the outlook is positive and optimistic, EUR will have a chance to assert strength. Moreover, the eurozone's Final Employment Change report is due later today which is expected to be unchanged at 0.3%. Besides, revised GDP is also expected to remain flat at 0.2%.

Meanwhile, the pair is trading with higher volatility now. Though GBP is currently gaining momentum, any positive outcome from the ECB today may lead to certain spikes in the pair. Nevertheless, EUR is unlikely to gain consistent momentum over GBP in the coming days ahead of BREXIT and headwinds in the eurozone's economy.

Now let us look at the technical view. The price broke and retested the 0.8650 area with a daily close that indicates further bearish momentum at least towards 0.8500 support area. Though the price is currently forming a Bullish Regular Divergence, it might see further bearish pressure toward a strong support like 0.8500 area to push higher again in the coming days. As the price remains below 0.8650 area, the bearish pressure is expected to continue.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română