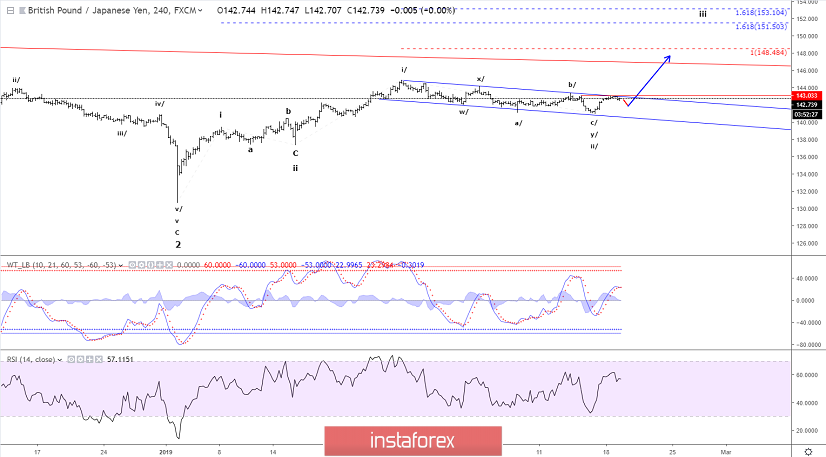

Key-resistance at 143.03 has capped the rally from 141.04, which keeps wave ii/ alive. The rally to 143.03 could be an x-wave calling for a final zig-zag decline in wave z towards support in the 140.35 - 140.67 to complete wave ii and set the stage for the next impulsive rally.

The second option is that an ending diagonal is developing as wave c/ of y/ of ii/. The target in both cases will be almost identical, but the later option is of course the more complicated pattern of the two, so for now we will try to track the decline to the support-zone between 140.35 - 140.67 as well as possible.

R3: 143.86

R2: 143.34

R1: 143.03

Pivot: 142.50

S1: 141.79

S2: 141.35

S3: 140.98

Trading recommendation:

We sold GBP at 142.65 with our stop+reverse placed at 143.10. We will take profit+reverse at 140.75.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română