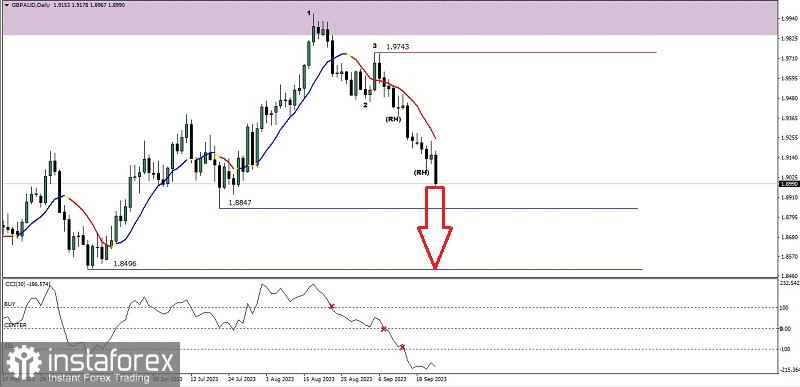

From the daily chart of the GBP/AUD cross currency pair, it can be seen that the CCI indicator has broken below its three main important levels and the price movement is below the WMA (20) which also has a downward slope and is supported by the appearance of the Bearish 123 pattern which is followed by the Bearish Ross Hook So it can be concluded that GBP/AUD is currently being dominated by Sellers so that in the next few days if there is no upward rally correction that exceeds level 1.9743 then GBP/AUD has the potential to fall down to level 1.8847 as the first target and if the momentum and volatility are sufficient to support then level 1.8496 will be the next target that will be tested.

(Disclaimer)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română