The AUD/JPY pair has been quite impulsive and non-volatile with the recent bearish momentum after rejecting off the 84.00 resistance area with a daily close. Japan having the record budget and better development plans without mass improvement or changes, did manage to help the currency to gain impulsive momentum over AUD.

AUD has been struggling with the mixed economic reports which caused JPY to gain constant bearish momentum in the pair. Recently, AUD Employment Change report has been published with an increase to 37.0k from the previous figure of 28.7k which was expected to decrease to 20.0k; and Unemployment Rate has had a negative result of increasing to 5.1% which was estimated to be unchanged at 5.0%. The mixed Employment results resulted in some hesitation in the market while leading AUD to lose further grounds.

On the other hand, BOJ Policy Rate report has been recently published unchanged at -0.10%, as expected. The BOJ is optimistic with the upcoming development of the economy which is quite a strong point for JPY to gain momentum. Recently, Japanese Prime Minister Abe has approved a record budget amount of 101.5 trillion dollars to be spent on welfare, public works, and defense. Though Japan failed to meet the inflation target, but it managed to sustain the constant pressure in the market leading to impulsive gains. Today, JPY National Core CPI decreased to 0.9% which was expected to be unchanged at 1.0%, but the report did not have a strong influence on the overall gains of JPY.

As for the current scenario, JPY is fundamentally stronger than AUD which is expected to lead to further gains in the future. Until AUD comes up with better economic results and optimistic future development plans, JPY is expected to dominate AUD further in the coming days.

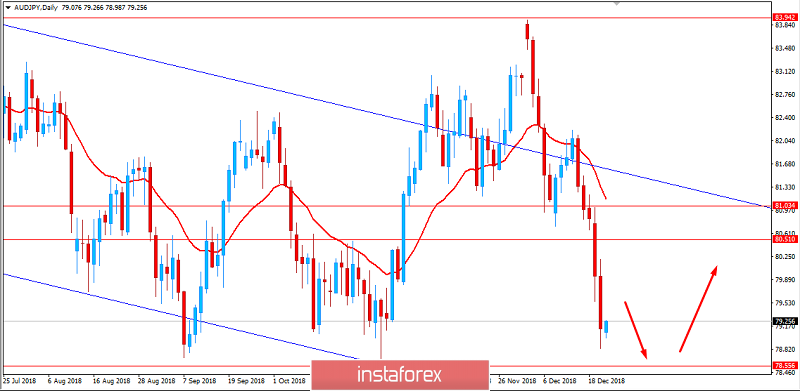

Now let us consider from a technical prospective. The price is currently approaching the 78.50 support area from where certain bullish pressure is expected in this pair which will lead to certain pullback towards the 80.50 area in the future. As the price remains below the 80.50 area with a daily close, the bearish bias is anticipated to continue.

SUPPORT: 77.50, 78.50

RESISTANCE: 80.50, 81.00, 84.00

BIAS: BEARISH

MOMENTUM: NON-VOLATILE and IMPULSIVE

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română