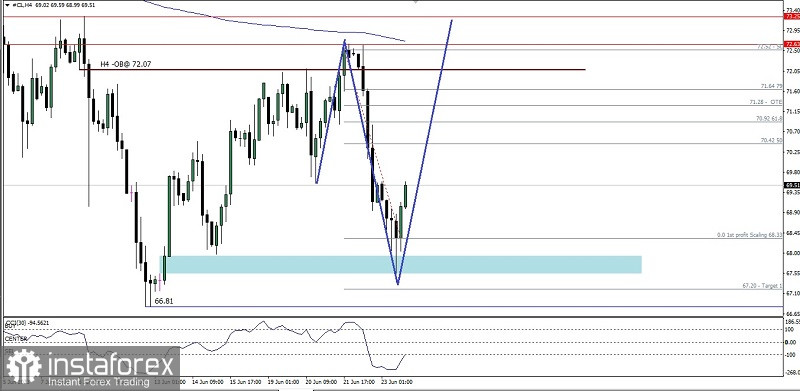

From what can be seen on the daily chart, the Crude Oil commodity asset is moving in a Sideways-Ranging condition, but the Seller is still dominant. This can be seen from the price movement, which is moving below the Moving Average. It can be seen that after testing the Bullish Fair Value Gap level (Cyan color ) which acts quite well as a support area level is now trying to test the 70.42 level as its main target and if the momentum and volatility are supportive enough then it is not impossible that the 72.07 level will again become the main target to be tested umpteenth time by #CL but if it is on its way to the target -the target level is suddenly a significant correction at #CL, especially if it manages to break below the 67.30 level, then all the scenarios described previously will cancel itself.

(Disclaimer)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română