In the British parliament before the Treasury Committee, the Imperial Professor Haskel, the candidate for the Bank of England's Monetary Policy Council is being questioned. The first reports suggest that the Haskel can place itself closer to the dovish side of MPC. GBP has particularly reacted to the words that Haskel sees the risk that Banf of England raises interest rates too fast. He added that Brexit and productivity are the biggest risks for the economic outlook.

On the other hand, Ian McCafferty from the Bank of England recalls his hawkish attitude. During the last two meetings, he voted on the interest rate increase and all indications are that he will support his vote in August. McCafferty said that BoE "should not be haggling with interest rate hikes", and postponing hikes for too long threatens a greater shock. From the currency market, McCafferty's comments are not a surprise, hence GBP does not find relief and the earlier (dovish) words of Haskel are still more powerful.

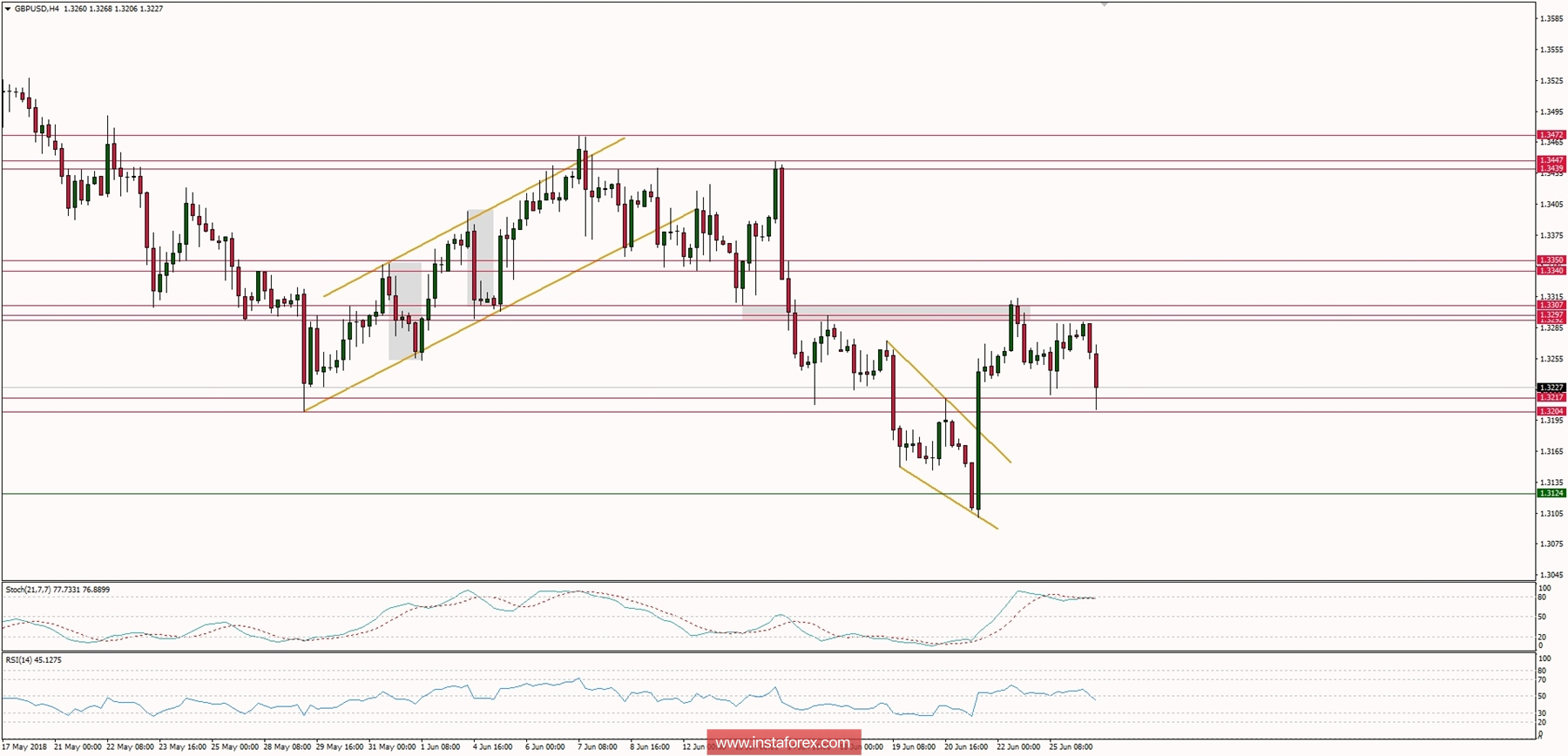

Let's now take a look at the GBP/USD technical picture at the H4 time frame. The market reaction for Haskel remarks is bearish and the price is now testing the local support at the level of 1.3204. The momentum indicator points to the downside and is now below its fifty level again. Any drop below the level of 1.3204 will only make the sell-off more aggressive. The next important support is seen at the level of 1.3124, just above the swing low at 1.3100.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română