The Friday's Canadian macroeconomic data strongly disappointed. Retail sales in April dropped unexpectedly by 1.2% m/m, and the same data without cars 0.1% m/m. The inflation in May slowed to 0.1% m/m from 0.3% m/m, and in annual terms remained at 2.2%. This can not be said of core inflation, which has receded to 1.3% from 1.5%. It is in the face of persisting uncertainty about the fate of the NAFTA agreement and the prospects of trade relations between the US and Canada, further reducing the chances of any policy changes by the Bank of Canada in the coming months.

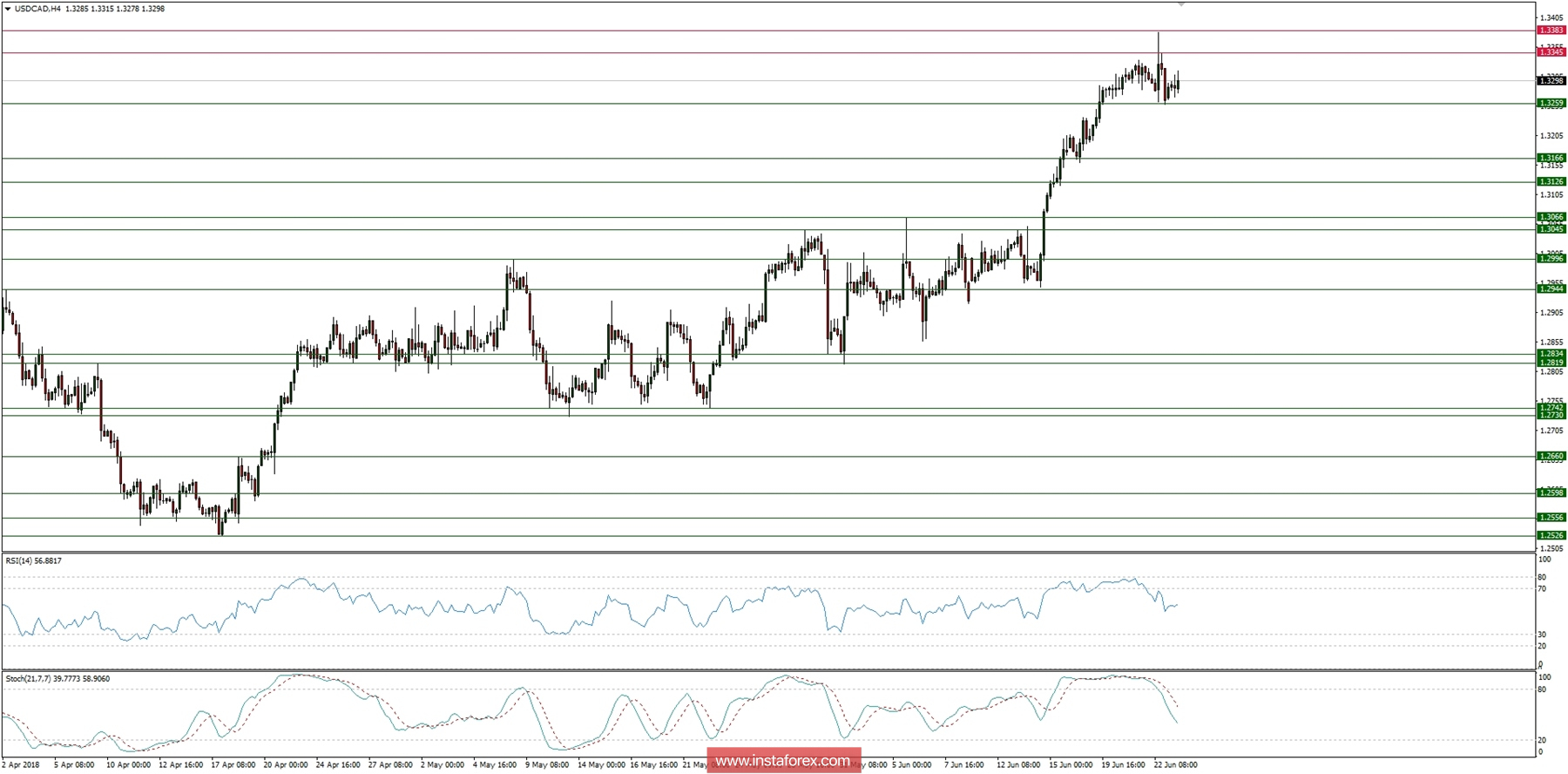

Let's now take a look at the USD/CAD technical picture at the H4 time frame. The market is still rallying higher after the breakout of the consolidation zone and made a recent local high at the level of 1.3383. Currently, after the data were published, the short-term pull-back is being developed and the price has slipped to the level of 1.3259 in overbought market conditions. The momentum remains above its fifty level, so there is still a chance for an uptrend continuation after the corrective pull-back is completed. The nearest technical resistance is seen at the level of 1.3345.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română