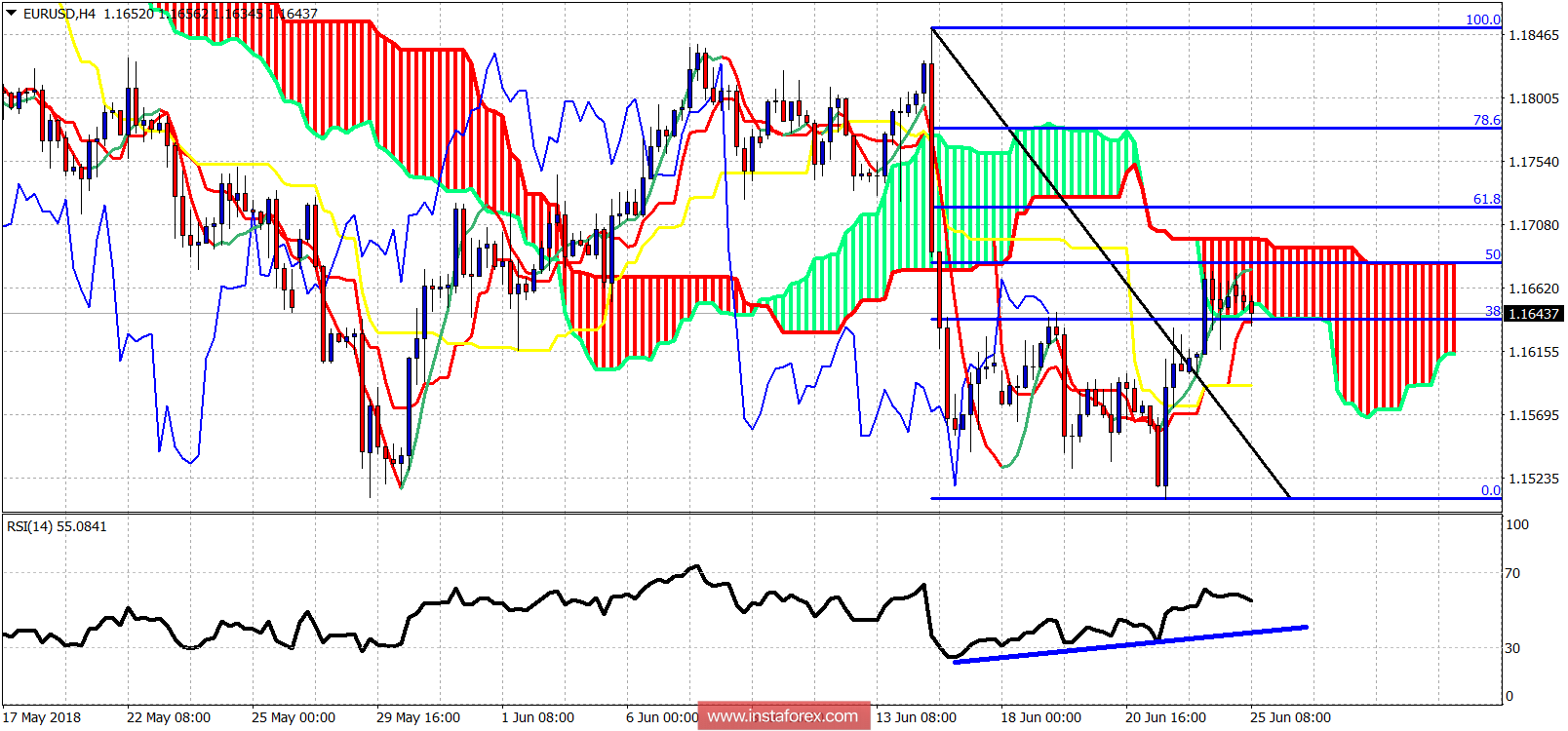

EUR/USD has stopped its rise at the 1.1673 level and is moving sideways and slightly lower since then. The price reached our target area of 1.1650-1.17 after breaking out of the wedge pattern near 1.1520 and this is also where we find cloud resistance.

Blue line - bullish divergence

The EUR/USD has retraced 50% of the decline from 1.1850 to 1.15. The price has hit the Ichimoku cloud resistance and has stopped its rise. A rejection at this area and a break below 1.1592 where we find the kijun-sen (yellow line indicator) will be a bearish sign and would imply that a new low should be seen. On the other hand, a break above 1.1673 and especially above the 4-hour Kumo at 1.1692 will open the way for a bigger bounce towards 1.1850-1.19.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română